EasyJet 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

27

www.easyJet.com

TIONAL EXCELLENCE CONTINUED

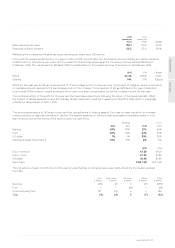

Risk description Mitigation

Industrial action

easyJet, and the aviation industry in general,

has a significant number of employees who are

members of trade unions. Industrial action taken

by easyJet employees, or by the employees of

key third-party service providers, could impact on

easyJet's ability to maintain its flight schedules.

This could adversely affect easyJet's reputation

and its operational and financial performance.

Link to strategy:

2 3 5

As easyJet operates across Europe there are 18 unions and nine representative

bodies across eight countries of which crew are members. easyJet seeks to

maintain positive working relationships with all trade unions and other

representative bodies.

Each of the countries in which easyJet operates has localised employment terms

and conditions. This mitigates the risk of large-scale internal industrial action

occurring at the same time.

Processes are in place to adapt to disruptions as a result of industrial action.

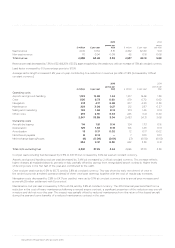

Senior management succession

easyJet's current and future success is reliant on

having the right people with the right capabilities

in key leadership positions.

Failure to develop and grow the capabilities

and behaviours required of senior management

so that there are clear successors for all key

business roles, could adversely affect easyJet's

ability to deliver its strategic objectives.

Link to strategy:

5

easyJet's aim is to develop talent from within. There are several talent

development programmes in place for individuals who have been identified

for fast-tracking into more senior roles as vacancies arise.

In addition, a management development programme is in place to develop

people management and senior leadership capabilities. These programmes

operate at various levels within the organisation.

There is an annual succession planning process.

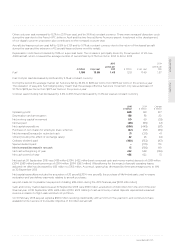

Single fleet risk

easyJet is dependent on Airbus as its sole

supplier for aircraft.

There are significant cost and efficiency

advantages of a single fleet, however,

there are two main associated risks:

• technical or mechanical issues that could

ground the full fleet, or part of the fleet,

which could cause negative perception; and

• valuation risks which crystallise when aircraft

exit the fleet. The main exposure at this time

is with the ageing A319 fleet, where easyJet

is reliant on the future demand for second-

hand aircraft.

Link to strategy:

3 4

The Board considers that the efficiencies achieved by operating a single fleet

type outweigh the risks associated with easyJet's single fleet strategy.

The Airbus A320 family (which includes the A319) is one of the two primary fleets

used for short-haul travel. There are approximately 6,000 A320 family aircraft

operating with a proven track record for reliability.

easyJet operates a rigorous established aircraft maintenance programme.

To mitigate the potential valuation risks, easyJet regularly reviews the second-

hand market and has a number of different options when looking at fleet

exit strategies. Leasing facilitates the exit of A319 aircraft from the fleet by

transferring residual value risk, and also provides flexibility in managing

the fleet size.

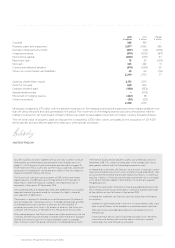

1

2

3

5

4

Link to strategy:

Build strong number 1 and 2 network positions

Drive demand, conversion and yields

Maintain cost advantage

Culture, People & Platform

Disciplined use of capital