EasyJet 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report Governance Accounts

87

www.easyJet.com

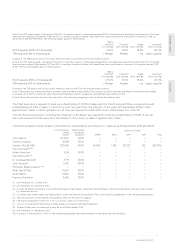

Area of focus How our audit addressed the area of focus

Goodwill and landing rights impairment assessment

Goodwill arises from acquisitions in previous years and has an indefinite

expected useful life. Landing rights (which are an intangible asset)

are considered by management to have an indefinite useful life as

they will remain available for use for the foreseeable future.

Goodwill and landing rights are tested for impairment at least annually

at the cash-generating unit (‘CGU’) level. The Group has one CGU,

being its route network, to which all goodwill and landing rights relate.

At 30 September 2015, they amounted, in aggregate, to £459 million

(refer to notes 1 and 8 to the accounts).

We focused on this assessment as the impairment test involves a

number of subjective judgements and estimates by management,

many of which are forward-looking. These estimates include key

assumptions surrounding the strategic plan through to 2020, fuel

prices, exchange rates, long-term economic growth rates and

discount rates.

We evaluated and challenged the future cash flow

forecasts of the CGU, and the process by which they

were drawn up, and tested the underlying value in use

calculations. In doing this, we compared the forecast to

the latest strategic plan presented to the Board, along

with comparing prior year budget to actual data, as this

informed as to the quality of the forecasting process.

The results of our evaluation proved to be satisfactory.

We also challenged the key assumptions for fuel prices,

exchange rates and long-term growth rates in the

forecasts by comparing them to economic and industry

forecasts; and the discount rate by assessing the cost of

capital for the Company and comparable organisations.

We found no material exceptions from these comparisons

and assessments.

We performed sensitivity analysis around the key

assumptions above to ascertain the extent of change

in those assumptions that either individually or collectively

would be required for the goodwill and landing rights

to be impaired. We found no material exceptions from

this analysis.

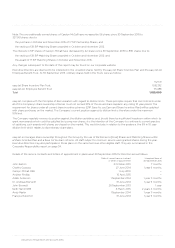

How we tailored the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the accounts as

a whole, taking into account the geographic and operational

structure of the Group, the accounting systems, processes and

controls, and the industry and regulatory environment in which

the Group operates.

The Group operates through the Company and its trading

subsidiary undertakings as set out on page 121 and the Group

accounts are a consolidation of these entities. The accounting

for these entities is largely centralised in the UK and our audit

scope comprises an audit of their complete financial information.

These procedures gave us the evidence that we needed for

our opinion on the Group’s accounts as a whole.

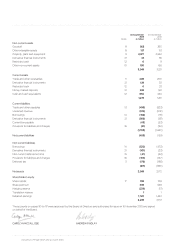

Materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for materiality.

These, together with qualitative considerations, helped us to

determine the scope of our audit and the nature, timing and

extent of our audit procedures on the individual account line

items and disclosures and in evaluating the effect of

misstatements, both individually and on the accounts as a whole.

Based on our professional judgement, we determined materiality

for the accounts as a whole as follows:

Overall group

materiality

£34 million (2014: £29 million).

How we

determined it

5% of profit before tax.

Rationale for

benchmark

applied

We applied this benchmark, a generally accepted

auditing practice, in the absence of indicators

that an alternative benchmark would be

more appropriate.

We agreed with the Audit Committee that we would report to

them misstatements identified during our audit above £2 million

(2014: £2 million) as well as misstatements below that amount

that, in our view, warranted reporting for qualitative reasons.

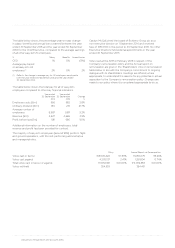

Going concern

Under the Listing Rules we are required to review the Directors’

statement, set out on page 22, in relation to going concern.

We have nothing to report having performed our review.

Under ISAs (UK & Ireland) we are also required to report to you

if we have anything material to add or to draw attention to

in relation to the Directors’ statement about whether they

considered it appropriate to adopt the going concern basis in

preparing the accounts. We have nothing material to add or

to draw attention to.

As noted in the Directors’ statement, the Directors have

concluded that it is appropriate to adopt the going concern

basis in preparing the accounts. The going concern basis

presumes that the Group and Company have adequate

resources to remain in operation, and that the Directors intend

them to do so, for at least one year from the date the accounts

were signed. As part of our audit we have concluded that the

Directors’ use of the going concern basis is appropriate.

However, because not all future events or conditions can be

predicted, these statements are not a guarantee as to the

Group’s and Company’s ability to continue as a going concern.