BMW 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

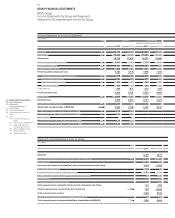

BMW Group

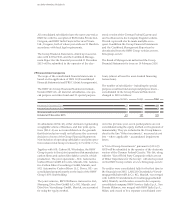

Cash Flow Statements for Group and Segments

Note Group

in € million 2015 2014

Net profit 6,396 5,817

Reconciliation between net profit and cash inflow / outflow from operating activities

Current tax 2,751 2,774

Other interest and similar income / expenses 239 127

Depreciation and amortisation of other tangible, intangible and investment assets 4,686 4,323

Change in provisions 296 1,103

Change in leased products – 3,299 – 2,720

Change in receivables from sales financing – 6,637 – 3,898

Change in deferred taxes 77 116

Other non-cash income and expense items 47 331

Gain / loss on disposal of tangible and intangible assets and marketable securities – 144 – 63

Result from equity accounted investments – 518 – 655

Changes in working capital – 293 – 551

Change in inventories 298 – 971

Change in trade receivables – 566 379

Change in trade payables – 25 41

Change in other operating assets and liabilities 550 323

Income taxes paid – 3,323 – 4,252

Interest received 132 137

Cash inflow / outflow from operating activities 43 960 2,912

Investment in intangible assets and property, plant and equipment – 5,889 – 6,099

Proceeds from the disposal of intangible assets and property, plant and equipment 38 36

Expenditure for investments – 7461 – 99

Proceeds from the disposal of investments 215 190

Investments in marketable securities and term deposits – 6,880 – 4,216

Proceeds from the sale of marketable securities and from matured term deposits 5,659 4,072

Cash inflow / outflow from investing activities 43 – 7,603 – 6,116

Issue / buy-back of treasury shares – –

Payments into equity 23 15

Payment of dividend for the previous year – 1,917 – 1,715

Intragroup financing and equity transactions – –

Interest paid – 264 – 133

Proceeds from the issue of bonds 13,007 10,892

Repayment of bonds – 8,908 – 7,249

Proceeds from new non-current other financial liabilities 9,715 5,900

Repayment of non-current other financial liabilities – 8,802 – 5,697

Change in current other financial liabilities 2,648 2,132

Change in commercial paper – 498 – 1,012

Cash inflow / outflow from financing activities 43 5,004 3,133

Effect of exchange rate on cash and cash equivalents 73 86

Effect of changes in composition of Group on cash and cash equivalents – 2

Change in cash and cash equivalents 43 – 1,566 17

Cash and cash equivalents as at 1 January 7,688 7,671

Cash and cash equivalents as at 31 December 6,122 7,688

1 Expenditure for investments includes the acquisition of shares in THERE Holding B. V., Amsterdam, amounting to € 668 million.

2 Interest relating to financial services business is classified as revenues / cost of sales.

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information