BMW 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79 COMBINED MANAGEMENT REPORT

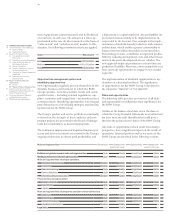

If residual value risks were to materialise, they could

have a high earnings impact over the two-year assess-

ment period. A medium earnings impact would then

arise for the segments affected (Financial Services and

Automotive). The level of risk is classified as high for

the Group as a whole.

The BMW Group classifies potential residual value op-

portunities as significant.

Interest rate risks and opportunities

Interest rate risks in the Financial Services segment re-

late to potential losses caused by changes in market

interest rates and can arise when fixed interest rate pe-

riods for assets and liabilities recognised in the balance

sheet do not match. Interest rate risks in the Financial

Services line of business are managed by raising refi-

nancing

funds with matching maturities and by em-

ploying interest rate derivatives.

If risks relating to interest rate risks were to materialise,

they could have a medium earnings impact over the

two-year assessment period. The level of risk attached

to interest rate risks is classified as high.

Interest rate developments that are positive compared

to the forecast constitute interest rate opportunities which

the BMW Group classifies as significant.

If the relevant recognition criteria are fulfilled,

deriva-

tives used by the BMW Group are accounted for as

hedging relationships. Further information on risks in

conjunction with financial instruments is provided in

note 42 to the Group Financial Statements.

Liquidity and operational risks in the

Financial Services segment

Use of the “matched funding principle” to finance the

Financial Services segment’s operations eliminates li-

quidity

risks to a large extent. Regular measurement

and monitoring ensure that cash inflows and outflows

from transactions in varying maturity cycles and cur-

rencies offset each other. The relevant procedures are

incorporated in the BMW Group’s target liquidity

con-

cept. Operational risks are defined in the Financial

Services segment as the risk of losses arising as a conse-

quence of the inappropriateness or failure of internal

procedures (process risks), people (personnel-related

risks), systems (infrastructure and IT risks) and external

events (external risks). These four categories of risk also

include related legal and reputational risks. The

com-

prehensive recording and measurement of risk scenarios

,

loss events and countermeasures in the Operational

Risk Management Suite (OpRisk-Suite) provides the ba-

sis for a systematic analysis and management of poten-

tial and / or actual operational risks. Annual self-assess-

ments are also carried out.

If operational risks were to materialise, they could have

a low earnings impact over the two-year assessment

period. The level of risk attached to operational risks is

classified as medium.

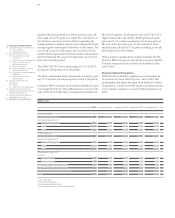

Legal risks

Compliance with the law is a basic prerequisite for the

success of the BMW Group. Current law provides the

binding framework for the BMW Group’s various busi-

ness activities around the world. The growing interna-

tional scale of the BMW Group’s operations, the com-

plexity of the business world and the whole gamut of

complex legal regulations increase the risk of laws not

being adhered to, simply because they are either not

known or not fully understood.

The BMW Group has established a Compliance Organi-

sation aimed at ensuring that its representative bodies,

managers and staff act in a lawful manner at all times.

Further information on the BMW Group’s Compliance

Organisation can be found in the section “Corporate

Governance”.

Like all internationally operating enterprises, the BMW

Group is confronted with legal disputes relating, in

particular, to warranty claims, product liability, infringe-

ments of protected rights and proceedings initiated

by government agencies. Any of these matters could,

among other outcomes, have an adverse impact on the

Group’s reputation. Such proceedings are typical for

the sector and can arise as a consequence of realigning

product or purchasing strategies to suit changed market

conditions. Particularly in the US market, class action

lawsuits and product liability risks can have substantial

financial consequences and cause damage to the Group’s

public image. The high quality of the Group’s products,

which is ensured by regular quality audits and ongoing

improvement measures, helps reduce this risk.

The BMW Group recognises appropriate levels of pro-

vision for lawsuits. A part of these risks, particularly

re-

garding the US market, is insured where this makes