BMW 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

116

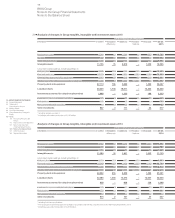

Tax increases as a result of non-deductible expenses

and tax reductions due to tax-exempt income

de-

creased significantly compared to one year earlier. As

in the previous year, tax increases as a result of non-

tax-deductible expenses were attributable primarily to

the impact of non-recoverable withholding taxes and

transfer price issues.

(2014: 30.7 %),

applicable for German companies, was

applied across the Group.

The line “Other variances” comprises primarily recon-

ciling

items relating to the Group’s share of results of

equity accounted investments.

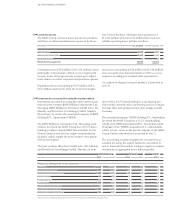

The allocation of deferred tax assets and liabilities to

balance sheet line items at 31 December is shown in the

following table:

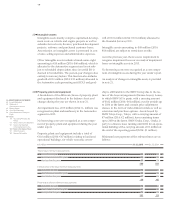

The difference between the expected and actual tax ex-

pense is explained in the following reconciliation:

Deferred tax assets Deferred tax liabilities

in € million 2015 2014 2015 2014

Intangible assets 10 11 1,977 1,706

Property, plant and equipment 20 50 376 400

Leased products 367 393 6,260 5,486

Other investments 5 5 11 12

Other assets 1,363 1,289 2,109 2,687

Tax loss carryforwards 548 566 – –

Provisions 4,187 4,175 178 95

Liabilities 2,654 2,827 478 602

Eliminations 3,281 2,945 715 690

12,435 12,261 12,104 11,678

Valuation allowance – 502 – 496 – –

Netting – 9,988 – 9,704 – 9,988 – 9,704

Deferred taxes 1,945 2,061 2,116 1,974

Net 87 171

in € million 2015 2014

Profit before tax 9,224 8,707

Tax rate applicable in Germany 30.7 % 30.7 %

Expected tax expense 2,832 2,673

Variances due to different tax rates – 119 – 55

Tax increases (+) / tax reductions (–) as a result of non-deductible expenses and tax-exempt income 42 150

Tax expense (+) / benefits (–) for prior years 164 275

Other variances – 91 – 153

Actual tax expense 2,828 2,890

Effective tax rate 30.7 % 33.2 %

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information