BMW 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

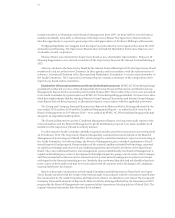

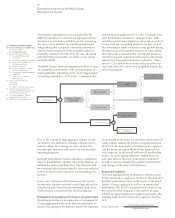

The business management system applied by the

BMW Group follows a value-based approach, with a

clear focus on achieving profitable growth, increasing

the value of the business for capital providers and

safeguarding jobs. Corporate autonomy can only be

ensured in the long term if the available capital is

profitably

employed. For this to be the case, the profit

generated must sustainably exceed the cost of equity

and debt capital.

The BMW Group’s internal management system is based

on a multilayered structure, with varying degrees of

detail applicable, depending on the level of aggregation.

Operating performance, for instance, is managed first

Due to the extremely high aggregate impact of vari-

ous factors, it is difficult to manage a business pro-

actively simply by focusing on value added. This

key indicator therefore only serves for intermediate

reporting purposes.

Relevant value drivers which could have a significant

impact on profitability and the value of the business are

defined for each controlling level. The financial and

non-financial value drivers referred to above are reflected

in the key performance indicators used to manage the

business.

In the case of project-related decisions, the system

in

corporates a project-oriented control logic focused on

value-based and return-based performance indicators,

which provide a crucial basis for decision-making.

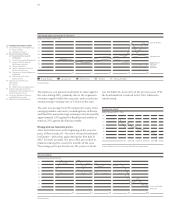

Management of operating performance at segment level

Operating performance at segment level is managed in

its most aggregated form on the basis of capital rates of

return. Depending on the business model, the segments

and foremost at segment level. In order to manage long-

term performance and assess strategic issues, addi-

tional

key performance figures are taken into account at

Group level for controlling purposes. In this context,

the contribution made to business value growth during

the financial year is measured in terms of “value added”.

This approach is translated for operational purposes

at both Group and segment level by means of key finan-

cial and non-financial performance indicators (“value

drivers”). The link between value added and the rele-

vant value drivers is shown in a simplified form in the

following diagram.

are measured on the basis of total return or the return on

equity capital, namely the return on capital employed

(RoCE) for the Automotive and Motorcycles segments

and the return on equity (RoE) for the Financial

Ser-

vices segment. As an overall reflection of profitability

(return on sales), capital efficiency (capital turnover)

and other factors, these key performance indicators

provide a cohesive insight into segment performance

and changes in the value of the business.

Automotive segment

The most aggregated key performance indicator used

for the Automotive segment is the RoCE. This indicator

provides useful information on the success with which

capital is being employed as well as on operational

profitability. The RoCE is measured on the basis of seg-

ment profit before financial result and the average

amount of capital employed in segment operations. The

strategic target for the Automotive segment’s RoCE is

26 %.

Profit before financial result

RoCE Automotive = Capital employed

General Information on the BMW Group

Management System

Revenues

Profit

×−

–

×

÷

÷

Expenses

Return on sales

Capital turnover

Capital employed

Cost of capital

Average weighted cost

of capital rate

Return on capital

(RoCE / RoE)

Value added