BMW 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

reversal may not, however, exceed the rolled-forward

amortised cost of the asset.

If there is any evidence of impairment of non-financial

assets (except inventories and deferred taxes), or if an

annual impairment test is required to be carried out –

i. e. for intangible assets not yet available for use, intan-

gible assets with an indefinite useful life and goodwill

acquired as part of a business combination – an impair-

ment test pursuant to IAS 36 (Impairment of Assets)

is performed. Each individual asset is tested separately

unless the cash flows generated by the asset cannot be

distinguished to a large degree from the cash flows

generated by other assets or groups of assets (cash-gen-

erating units / CGUs). For the purposes of the impair-

ment test, the asset’s carrying amount is compared with

its recoverable amount, the latter defined as the higher

of the asset’s fair value less costs to sell and its value in

use. An impairment loss is recognised when the recover-

able amount is lower than the asset’s carrying amount.

Fair value is the price that would be received to sell an

asset in an orderly transaction between market

partici-

pants at the measurement date. The value in use corre-

sponds to the present value of future cash flows ex-

pected to be derived from an asset or group of assets.

The first step of the impairment test is to determine the

value in use of an asset. If the calculated value in use is

lower than the carrying amount of the asset, then its

fair value less costs to sell are also determined. If the lat-

ter is also lower than the carrying amount of the asset,

then an impairment loss is recorded, reducing the car-

rying amount to the higher of the asset’s value in use or

fair value less costs to sell. The value in use is deter-

mined on the basis of a present value computation.

Cash flows used for the purposes of this calculation are

derived from long-term forecasts approved by manage-

ment. The long-term forecasts themselves are based on

detailed forecasts drawn up at an operational level and,

based on a planning period of six years, correspond

roughly to a typical product’s life-cycle. For the pur-

poses of calculating cash flows beyond the planning pe-

riod, the asset’s assumed residual value does not take

growth into account. Forecasting assumptions are con-

tinually brought up to date and regularly compared with

external sources of information. The assumptions used

take account in particular of expectations of the profita-

bility of the product portfolio, future market share de-

velopments, macro-economic developments (such as

currency, interest rate and raw materials prices) as well

as the legal environment and past experience. Cash

flows of the Automotive and Motorcycles CGUs are dis-

counted using a risk-adjusted pre-tax weighted average

cost of capital (WACC) of 12.0 % (2014: 12.0 %). In the

case of the Financial Services CGU, a sector-compatible

pre-tax cost of equity capital of 13.4 % (2014: 13.4 %) is

applied. In conjunction with the impairment tests for

CGUs, sensitivity analyses are performed for the main

assumptions. Analyses performed in the year under

re-

port confirmed, as in the previous year, that no impair-

ment loss was required to be recognised.

If the reason for a previously recognised impairment

loss no longer exists, the impairment loss is reversed

up to the level of the recoverable amount, capped at

the level of rolled-forward amortised cost. This does

not apply to goodwill: previously recognised impair-

ment losses on goodwill are not reversed. No reversals

of impairment losses were recorded in the financial

year 2015.

Investments accounted for using the equity method are

(except when the investment is impaired) measured at

the Group’s share of equity taking account of fair value

adjustments on acquisition. As an exception from this

rule, the associated company, THERE Holding B. V.,

Amsterdam, is included in the Group

Financial State-

ments for the financial year 2015 at its acquisition cost

(at 4 December 2015). Investments accounted for using

the equity method comprise joint ventures and signifi-

cant associated companies.

Investments in non-consolidated Group companies,

non-consolidated joint operations and interests in

asso-

ciated companies, joint ventures and participations

not

accounted for using the equity method, are reported

as Other investments, measured at their fair value. If

this value is not available or cannot be determined relia-

bly, they are measured at cost.

Non-current marketable securities are measured accord-

ing to the category of financial asset to which they are

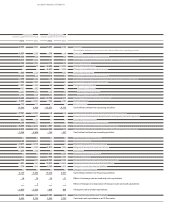

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information