BMW 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135 GROUP FINANCIAL STATEMENTS

income” and hence directly in equity (within revenue

reserves).

Past service cost arises where a BMW Group entity in-

troduces a defined benefit plan or changes the benefits

payable under an existing plan. These costs are

recog-

nised immediately in the income statement. Similarly,

gains and losses arising on the settlement of a defined

benefit plan are recognised immediately in the income

statement.

The defined benefit obligation is calculated on an ac-

tuarial basis. The actuarial computation requires the

use of estimates and assumptions, which depend on the

economic situation in each particular country. The most

important assumptions applied by the BMW Group are

shown below. The following weighted average values

have been used for Germany, the United Kingdom and

other countries:

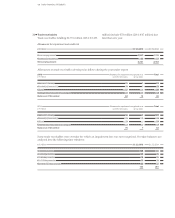

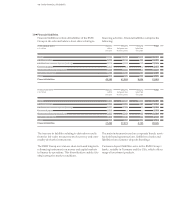

31 December Germany United Kingdom Other

in % 2015 2014 2015 2014 2015 2014

Discount rate 2.51 2.10 3.58 3.40 3.83 3.48

Pension level trend 1.60 1.60 2.43 2.43 0.02 0.03

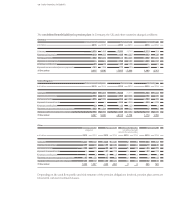

In Germany, the so-called “pension entitlement trend”

(Festbetragstrend) also represents a significant actuarial

assumption for the purposes of determining benefits

payable at retirement and was left unchanged at 2.0 %.

By contrast, the salary level trend assumption is subject

to a comparatively low level of sensitivity within the

BMW Group. The calculation of the salary level trend in

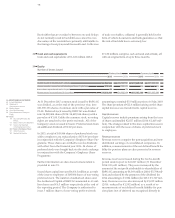

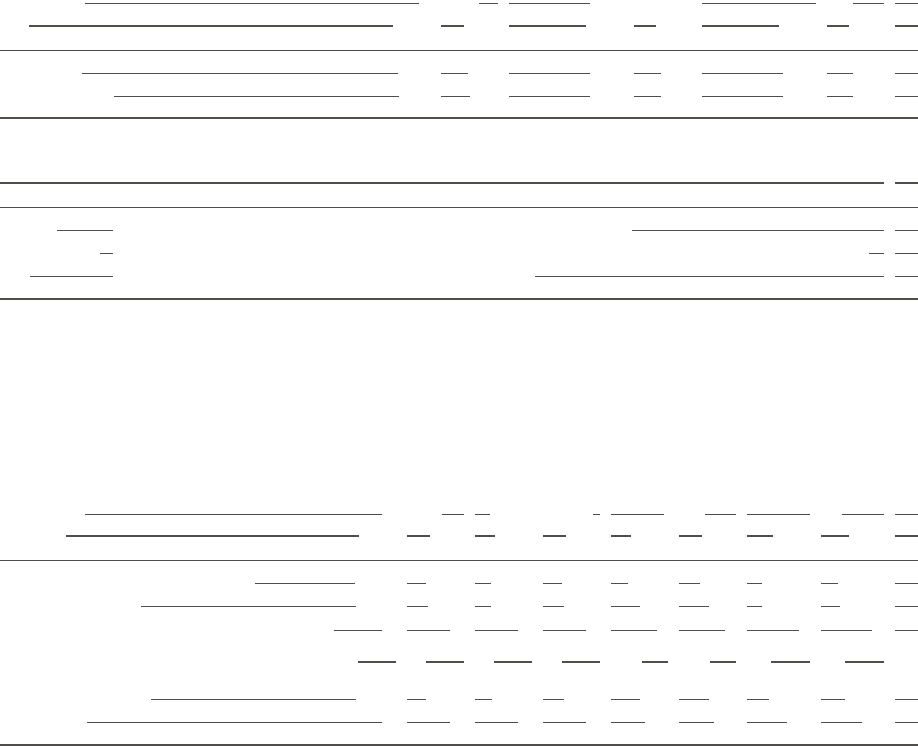

The following mortality tables are applied in countries, in which the BMW Group has significant defined benefit plans:

the UK also takes account of restrictions due to caps and

floors.

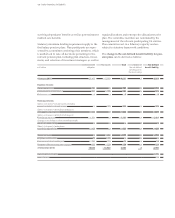

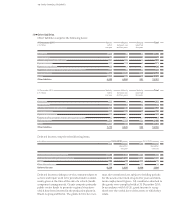

Based on the measurement principles contained in

IAS 19, the following balance sheet carrying amounts

apply to the Group’s pension plans:

31 December Germany United Kingdom Other To t a l

in € million 2015 2014 2015 2014 2015 2014 2015 2014

Present value of defined benefit obligations 9,215 9,636 9,327 9,499 1,384 1,327 19,926 20,462

Fair value of plan assets 7,855 7,323 8,153 7,734 922 804 16,930 15,861

Effect of limiting net defined benefit asset to asset ceiling – – – – 3 2 3 2

Carrying amounts at 31 December 1,360 2,313 1,174 1,765 465 525 2,999 4,603

thereof pension provision 1,360 2,313 1,174 1,765 466 526 3,000 4,604

thereof assets – – – – – 1 – 1 – 1 – 1

Germany Mortality Table 2005 G issued by Prof. K. Heubeck (with invalidity rates reduced by 50 %)

United Kingdom S1PA tables weighted accordingly, and S1NA tables minus 2 years, both with a minimum long term annual improvement allowance

USA RP2014 Mortality Table with collar adjustments projected with MP2015