BMW 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

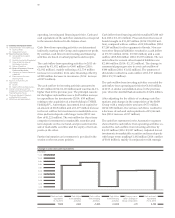

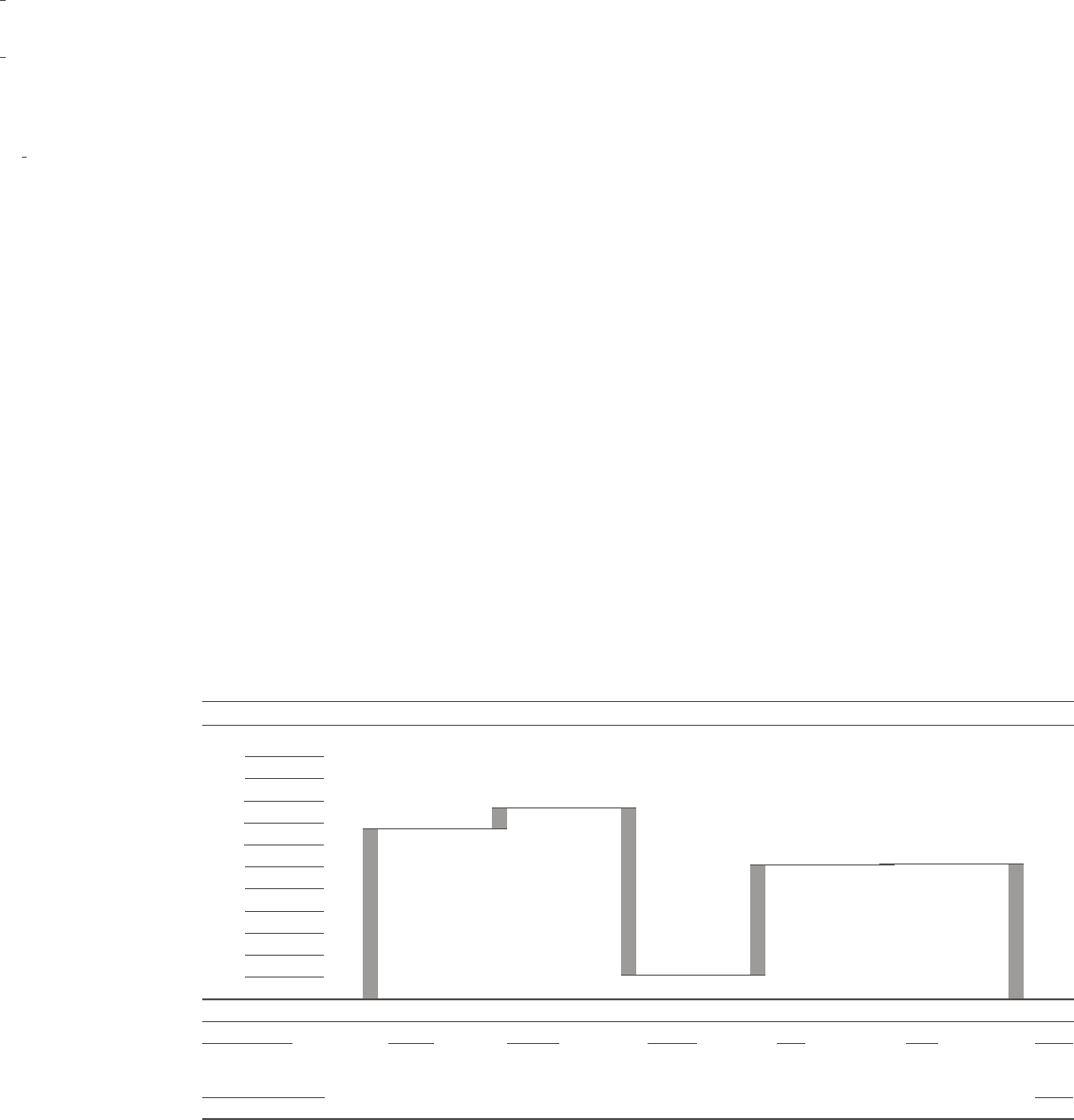

operating, investing and financing activities. Cash and

cash equivalents in the cash flow statements correspond

to the amount disclosed in the balance sheet.

Cash flows from operating activities are determined

indirectly, starting with Group and segment net profit.

By contrast, cash flows from investing and financing

activities are based on actual payments and receipts.

The cash inflow from operating activities in 2015 de-

creased by € 1,952 million to € 960 million (2014:

€ 2,912 million), mainly reflecting a € 2,739 million

increase in receivables from sales financing offset by

a

€ 298 million decrease in inventories (2014: increase

of € 971 million).

The cash outflow for investing activities amounted to

€ 7,603 million (2014: € 6,116 million) and was thus 24.3 %

higher than in the previous year. The principal reasons

for the higher cash outflow were a € 647 million increase

in expenditure for investments (2014: € 99 million)

relating to the acquisition of a shareholding in THERE

Holding B.V., Amsterdam, (accounted for at equity) for

an amount of € 668 million and a € 1,077 million increase

in the net outflow for investments in marketable secu-

rities and term deposits with longer terms (2015: out-

flow of € 1,221 million). The net outflow for these items

comprises investments in marketable securities and

term deposits on the one hand, and proceeds from the

sale of marketable securities and the expiry of term de-

posits on the other.

Further information on investments is provided in the

section on the net assets position.

Cash inflow from financing activities totalled € 5,004 mil-

lion

(2014: € 3,133 million). Proceeds from the issue of

bonds brought in € 13,007 million (2014: € 10,892

mil-

lion), compared with an outflow of € 8,908 million (2014:

€ 7,249 million) for the repayment of bonds. Non-cur-

rent other financial liabilities resulted in a cash inflow

of € 9,715 million (2014: € 5,900 million) and a cash

outflow of € 8,802 million (2014: € 5,697 million). The net

cash inflow for current other financial liabilities was

€ 2,648 million (2014: € 2,132 million). The change in

commercial paper gave rise to a net cash outflow of

€ 498 million (2014: € 1,012 million). The payment of

dividends resulted in a cash outflow of € 1,917 million

(2014: € 1,715 million).

The cash outflow from investing activities exceeded the

cash inflow from operating activities by € 6,643 million

in 2015. A similar constellation arose in the previous

year, when the shortfall had amounted to € 3,204 million.

After adjusting for the effects of exchange rate fluc-

tuations

and changes in the composition of the BMW

Group with a total positive amount of € 73 million

(2014: € 88 million), the various cash flows resulted in

a

decrease of cash and cash equivalents of € 1,566 mil-

lion (2014: increase of € 17 million).

The cash flow statement for the Automotive segment

shows that the cash inflow from operating activities ex-

ceeded the cash outflow from investing activities by

€ 4,312 million (2014: € 3,587 million). Adjusted for net

investments in marketable securities and term deposits

with longer terms totalling € 1,092 million (2014: outflow

of € 106 million), mainly in conjunction with strategic

Change in cash and cash equivalents

in € million

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Cash and cash Cash inflow Cash outflow Cash inflow Currency trans- Cash and cash

equivalents from operating from investing from financing lation, changes in equivalents

31.12. 2014 activities activities activities Group composition 31.12. 2015

7,688 + 960 – 7,603 + 5,004 + 73 6,122