BMW 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

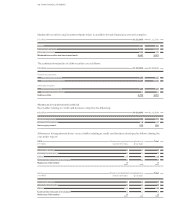

Company rating Moody’s Standard & Poor’s

Non-current financial liabilities A2 A +

Current financial liabilities P-1 A-1

Outlook positive stable

With their current long-term ratings of A+ (Standard &

Poor’s) and A2 (Moody’s), the agencies continue to

confirm BMW AG’s robust creditworthiness for debt

with a term of more than one year. BMW AG’s credit-

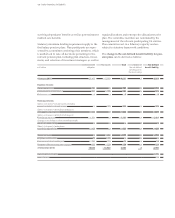

Equity attributable to shareholders of BMW AG increased

during the financial year by 0.1 percentage points,

primarily reflecting the increase in revenue reserves.

Since December 2013, the BMW AG has a long-term

rating of A+ (with stable outlook) and a short-term rating

of A-1 from the rating agency Standard & Poor’s, cur-

rently the highest rating given by Standard & Poor’s to

a European car manufacturer. Since July 2011, the

worthiness for short-term debt is also classified by the

rating agencies as very good, thus enabling it to obtain

refinancing funds on competitive conditions.

BMW AG has a long-term rating of A2 (with stable out-

look) and a short-term rating of P-1 from the rating

agency Moody’s. In March 2015, Moody’s raised the

outlook from “stable” to “positive” and at the same

time confirmed the long-term and short-term ratings

of A2 and P-1 respectively. This means that BMW AG

continues to enjoy the best ratings of all European car

manufacturers, clearly reflecting the financial strength

of the BMW Group.

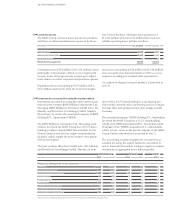

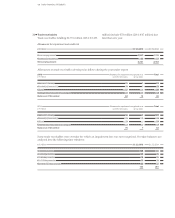

Pension provisions

Pension provisions are recognised as a result of commit-

ments to pay future vested pension benefits and current

pensions to present and former employees of the BMW

Group and their dependants. Depending on the legal,

economic and tax circumstances prevailing in each coun-

try,

various pension plans are used, based generally on

the length of service, salary and remuneration structure

of the employees involved. Due to similarity of nature,

the obligations of BMW Group companies in the USA

and of BMW (South Africa) (Pty) Ltd., Pretoria, for post-

retirement medical care are also accounted for as pen-

sion provisions in accordance with IAS 19.

Post-employment benefit plans are classified as either

defined contribution or defined benefit plans. Under

defined contribution plans an enterprise pays fixed

contributions into a separate entity or fund and does

not assume any other obligations.

The total pension ex-

pense for defined contribution plans of the BMW Group

amounted to € 71 million (2014: € 60 million).

Employer contributions paid to state pension insurance

programmes totalled € 571 million (2014: € 517 million).

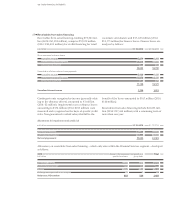

Under defined benefit plans the enterprise is required to

pay the benefits granted to present and past employees.

Defined benefit plans may be funded or unfunded, the

latter sometimes covered by accounting provisions.

Pension commitments in Germany are mostly covered

by assets contributed to BMW Trust e. V. , Munich, in

conjunction with a contractual trust arrangement (CTA).

The main other countries with funded plans were the

UK, the USA, Switzerland, the Netherlands, Belgium

and Japan. In the meantime, most of the defined bene-

fit plans have been closed to new entrants.

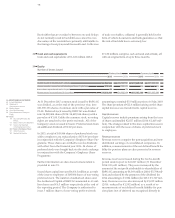

In the case of externally funded plans, the defined bene-

fit obligation is offset against plan assets measured at

their fair value. Where the plan assets exceed the pen-

sion

obligations and the BMW Group has a right of

re-

imbursement or a right to reduce future contributions,

it reports an asset (within “Other financial assets”) at

an amount equivalent to the present value of the future

economic benefits attached to the plan assets. If the plan

is externally funded, a liability is recognised under

pension provisions where the benefit obligation exceeds

fund assets.

Remeasurements of the net liability arise from changes

in the present value of the defined benefit obligation,

the fair value of the plan assets or the asset ceiling. Rea-

sons for remeasurements include changes in financial

and demographic assumptions as well as changes in the

detailed composition of beneficiaries. Remeasurements

are recognised immediately in “Other comprehensive

35

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information