BMW 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

56

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

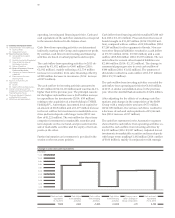

The Group equity ratio at the end of the reporting period

was 24.8 % (31 December 2014: 24.2 %). The equity ratio

of the Automotive segment was 40.1 % (31 December

2014: 39.2 %) and that of the Financial Services segment

was 8.2 % (31 December 2014: 8.8 %).

Overall, the results of operations, financial position and

net assets position of the BMW Group continued to de-

velop positively during the year under report.

Compensation Report

The compensation of the Board of Management com-

prises

both a fixed and a variable component. Bene-

fits are also payable – primarily in the form of pension

benefits – at the end of members’ mandates.

Further

details, including an analysis of remuneration by

each individual, are disclosed in the Compensation

Report, which can be found in the section “Statement

on Corporate Governance”. The Compensation

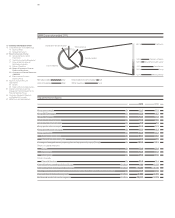

Balance sheet structure – Group

Total equity and liabilities in € billion

2015 2014 2014 2015

172 155 155 172

Non-current assets 64 %

5 %

37 %

63 %

38 %

38 %

24 %

36 %

Current assets

4 %

thereof cash and cash equivalents

37 % Non-current provisions and liabilities

38 % Current provisions and liabilities

25 % Equity

Balance sheet structure – Automotive segment

Total equity and liabilities in € billion

2015 2014 2014 2015

83 79 79 83

Non-current assets 48 %

7 %

54 %

46 %

43 %

18 %

39 %

52 %

Current assets

5 %

thereof cash and cash equivalents

17 % Non-current provisions and liabilities

43 % Current provisions and liabilities

40 % Equity