BMW 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23 COMBINED MANAGEMENT REPORT

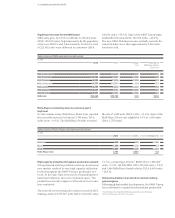

General economic environment in 2015

The world economy grew at a rate of 3.1 % in 2015. The

USA recorded robust growth, while the Chinese govern-

ment’s

plan to transform the country’s economy to a

more stable, sustainable level continued to take effect.

Falling demand in China held down the growth rate, ex-

erting a particularly crippling impact on the economies

of raw material exporting countries such as Brazil and

Russia. Moreover, the prospect of the US Federal Reserve

Bank tightening its monetary policy additionally damp-

ened the outlook for emerging economies. These factors

resulted in further capital outflows, lower investment

and currency devaluation in many developing countries.

Despite signs of a resurgence of Greece’s problems, mar-

kets in the eurozone continued to recover.

After some initial doubt regarding the robustness of the

economy, the US Federal Reserve Bank set the expected

interest rate turnaround in motion. The upheavals on

capital markets feared by the financial market only had

a limited impact.

In the eurozone, economic output grew more strongly

than one year earlier, with a gross domestic product

(GDP) increase of 1.5 %, helped by the monetary policies

of the European Central Bank (ECB). At 1.7 %, Germany

again played an important role in driving the European

economy. France (+ 1.1 %) and Italy (+ 0.7 %) also recorded

higher growth rates for the twelve-month period.

Similarly, the majority of southern Europe’s economies

showed a year-on-year improvement. For example,

Spain at 3.2 % and Portugal, at 1.5 %, both contributed

towards the continued economic recovery of the

euro

zone.

At 2.2 %, the UK economy grew more slowly than one

year earlier. Nevertheless, as in all years since 2011, the

growth rate was higher than that of the eurozone. The

UK government made good use of the positive economic

environment to reduce the budget deficit to its lowest

level since 2007. Domestic consumer spending again

served as a pillar of the economy.

The cyclical upturn in the USA gained further momen-

tum

in 2015. The growth rate stood at 2.4 %, marginally

higher than one year earlier. The upward trend of the

US economy, now reaching as far back as 2010,

con-

tinues to benefit from robust levels of consumer spending

.

The stable economic situation on one hand and the

expected rise in inflation on the other hand prompted

the Federal Reserve Bank to usher in the interest rate

turnaround in December 2015.

The Japanese economy was unable to gain any signifi-

cant

momentum in 2015. With GDP growth at only

0.6 %, it was the weakest of all the G7 countries. The

Bank of Japan continued its expansionary monetary

policies throughout 2015.

In China, the realigned economic strategy introduced

by the government led to a moderate slowdown in the

pace of economic growth (+ 6.9 %), with the growth

rate

falling below the 7 % mark for the first time since

1990. Despite the ongoing transformation from an

investment to a consumer-oriented economy and

sharp

stock market corrections in both mid-2015 and

early 2016, the Chinese economy has shown itself to

be

stable.

Apart from India at 7.4 %, the other BRIC states failed to

live up to expectations for growth in 2015. Brazil and

Russia, both of which rely on the export of raw materials,

recorded negative growth of 3.6 % and 3.8 % respectively.

Neither of these countries was able to find a way out

of the currently difficult situation and remained in re-

cession.

Currency markets

The US dollar averaged an exchange rate of 1.11 to

the euro in 2015 and was therefore significantly stronger

than in the previous year. The different direction in

monetary policy currently being pursued by the

Euro-

pean Central Bank and the US Federal Bank (Fed) caused

the US dollar to appreciate in value against the euro

from US$ 1.16 to US$ 1.09 (based on monthly averages)

over the course of the twelve-month period.

The British pound also gained in value, rising to an

average annual exchange rate of 0.73 to the euro. Unlike

the Fed, the Bank of England (BoE) has not yet seen any

acute need to raise reference interest rates.

As its value is coupled to that of the US dollar, at 6.97,

the Chinese renminbi also gained in value against the

euro compared to the previous year. The upward trend

was temporarily halted when Chinese stock markets

witnessed a turbulent phase, only for some of the lost

ground to be regained by the end of the year.

Report on Economic Position

General and Sector-specific Environment