BMW 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 COMBINED MANAGEMENT REPORT

Capital employed corresponds to the sum of all current

and non-current operational assets, less liabilities that

do not incur interest (e. g. trade payables). Non-interest-

bearing liabilities are those capital shares which are

available to the operative business without interest. These

include, for example, trade payables.

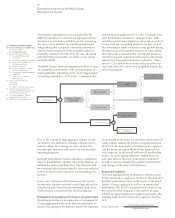

Due to the key importance of the Automotive segment

for the Group as a whole, consideration is also given

to additional key performance indicators, with varying

degrees of detail, which have a significant impact on

RoCE and hence on segment performance. The most

important of these value drivers are deliveries to

cus-

tomers, segment revenues and – as the key performance

indicator for segment profitability – the operating re-

turn on sales. Average carbon emissions for the fleet

are also taken into account, reflecting their potential

impact on earnings in the short term in the form of

ongoing

development expenses, and, in the long term,

the consequences of meeting regulatory requirements.

For these purposes, “carbon emissions for the fleet”

corresponds

to average emissions of CO

2

for new cars

sold in the EU-28

countries.

Managing the business on the basis of key value drivers

makes it easier to identify the reasons for changes in

RoCE and to define suitable measures to influence its

development.

Motorcycles segment

As with the Automotive segment, operating performance

for the Motorcycles segment is managed on the basis of

RoCE. Capital employed is measured using the same

procedures as in the Automotive segment. The strategic

target for the Motorcycles segment’s RoCE is 26 %.

Profit before financial result

RoCE Motorcycles

= Capital employed

The number of vehicles delivered to customers is also

taken into account as a non-financial value driver.

Financial Services segment

As is common practice in the banking sector, the per-

formance of the Financial Services segment is measured

on the basis of return on equity. RoE is defined as seg-

ment profit before taxes, divided by the average

amount

of equity capital attributable to the Financial Services

segment. The target is a sustainable return on equity

of

at least 18 %.

RoE Financial

Profit before tax

Services =

Equity capital

Strategic management at Group level

Strategic management, including quantification of the

financial impact of strategic issues on long-term

fore-

casting, is performed primarily at Group level. The

most significant performance indicators for these pur-

poses are Group profit before tax and the size of the

Group’s workforce at the year-end. Group profit before

tax is a good overall measure of the Group’s

perfor-

mance after consolidation procedures, and provides a

transparent basis for comparing performance, particu-

larly over time. The size of the Group’s workforce is

monitored as an additional key non-financial perfor-

mance

indicator.

Information provided by these two key performance in-

dicators is supplemented by the measurement of value

added. This highly aggregated performance indicator

provides an insight into capital efficiency and the (op-

portunity)

cost of capital required to generate Group

profit. Value added corresponds to the amount of earn-

ings over and above the cost of capital and gives an in-

dication of whether the Group is meeting the minimum

requirements for the rate of return expected by capital

providers. A positive value added means that a com-

pany is generating more additional value than the cost

of capital.

Value added Group = earnings amount – cost of capital

= earnings amount – (cost of capital rate ×

capital employed)

Capital employed comprises the average amount of

Group equity employed during the year as a whole, the

financial liabilities of the Automotive and Motorcycles

segments, and pension provisions. “Earnings amount”

for these purposes corresponds to Group profit before

tax, adjusted for interest expense incurred in conjunc-

tion with the pension provision and on the financial

liabilities of the Automotive and Motorcycles segments

(earnings before interest expense and taxes).

in € million Earnings amount Cost of capital (EC + DC) Value added Group

2015 2014 2015 2014 2015 2014

BMW Group 9,723 9,051 6,040 5,212 3,683 3,839