BMW 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 COMBINED MANAGEMENT REPORT

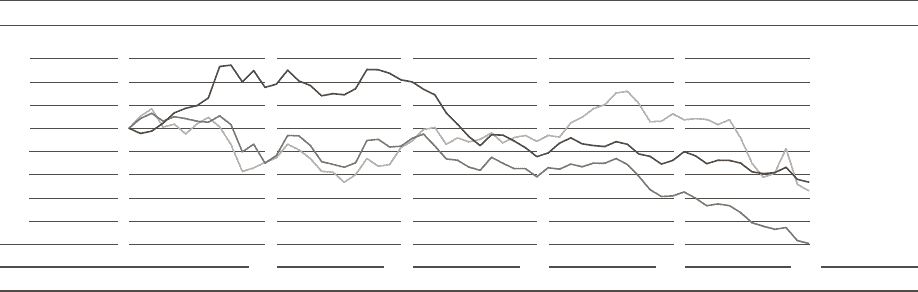

Precious metals prices stabilised for a short period at the

beginning of the year, before continuing their long-term

downward trend for the remainder of the twelve-month

period. The drop in prices reflects overcapacities on

the

supply side, combined with weak demand on world

markets.

There was no sign of a turnaround on the world’s steel

markets during the period under report. Here, too,

the general slide in raw materials prices was reflected

in

lower steel prices year-on-year.

Automobile markets

Worldwide registrations of passenger cars and light

com-

mercial vehicles grew by 3.3 % to 82.4 million units.

The two largest automobile markets, the USA and China,

were once again the mainstays driving this outcome.

Registration figures in China, for instance, increased by

8.9 % to 20.5 million units. Although this number points

to a weaker performance than one year earlier, the

Chinese market nevertheless increased the gap between

itself and the US market, which grew by 5.7 % to 17.5 mil-

lion units.

Automobile markets in Europe picked up where they had

left off the previous year, growing by 9.2 % (14.2 million

units) during the period under report. Excluding registra-

tions

in Germany, the European market fared slightly

better with a 10.3 % increase to 11.0 million units. The

German automobile market grew by 5.6 % to 3.2 million

units and therefore accounted for nearly a quarter of all

new registrations in Europe (22.6 %). France (1.9 million

units; + 6.8 %) and Italy (1.6 million units; + 15.5 %) both

saw robust growth, which also contributed to the re-

covery.

Europe’s growth was also helped by a repeated

dynamic performance in Spain (1.0 million units;

+ 20.9 %). Registrations in the United Kingdom were

6.3 % higher at 2.6 million units

.

Japan’s automobile market contracted in 2015, with

new registrations falling and totalling only 4.9 million

units ( – 9.8 %).

Automobile markets in major emerging economies

continued to suffer from recession in 2015. The Russian

market shrank by more than one-third (1.5 million

units; – 36.0 %) and the Brazilian market by a good quar-

ter (2.5 million units; – 25.7 %).

Motorcycle markets

The world’s motorcycle markets in the 500 cc plus class

grew by 4.7 % in 2015. Motorcycle registrations in Europe

were up by 8.5 %, mainly due to a sharp recovery in

southern Europe. Italy recorded double-digit growth,

with registrations 11.3 % up on the previous year. Ger-

many’s motorcycle market reported a 4.5 % increase,

while France finished at a similar level to the previous

year (+ 0.3 %). The US market grew by 3.6 %.

Financial services markets

While the majority of industrialised countries witnessed

an improvement in economic fundamentals in 2015,

market conditions were highly unfavourable for some of

the world’s major emerging economies.

After a slow start to the year, the US economy and em-

ployment

market returned to an upward trend as from

the second quarter. The rate of inflation remained

ex-

tremely low throughout the year, initially prompting the

Fed to adopt a “wait-and-see” approach

regarding an

Precious metals price trend

(Index: December 2010 = 100)

130

120

110

100

90

80

70

60

11 12 13 14 15

Source: Reuters.

Palladium

Gold

Platinum