BMW 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

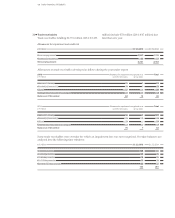

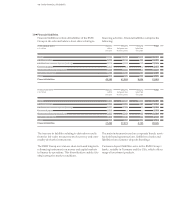

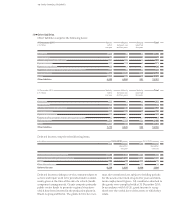

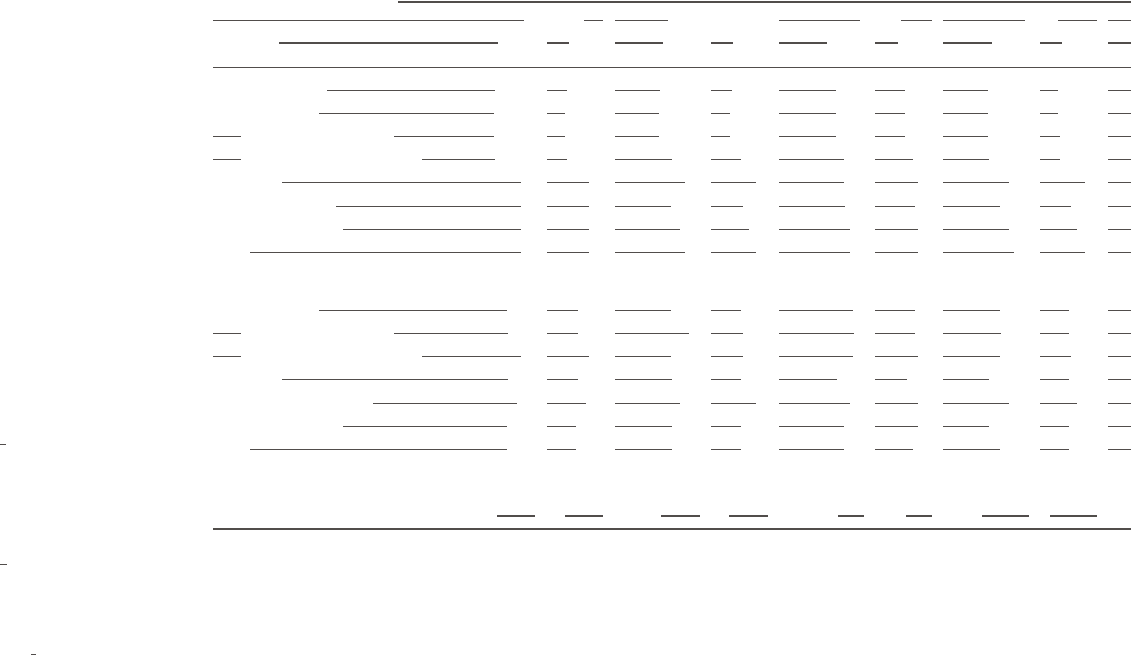

Plan assets in Germany, the UK and other countries comprised the following:

Employer contributions to plan assets are expected to

amount to € 692 million in the coming year. Plan assets

of the BMW Group include own transferable financial

instruments amounting to € 6 million (2014: € 5 million).

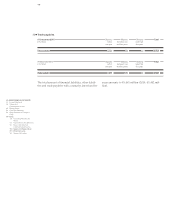

The BMW Group is exposed to risks arising from defined

benefit plans on the one hand and defined contribution

plans with a minimum return guarantee on the other.

Pension obligations to employees under such plans are

measured on the basis of actuarial reports. Future

pen-

sion payments are discounted by reference to market

yields on high quality corporate bonds. These yields are

subject to market fluctuation and influence the level

of

pension obligations. Furthermore, changes in other

actuarial parameters, such as expected rates of inflation,

also have an impact on pension obligations.

A substantial portion of plan assets is invested in debt

instruments in order to minimise the effect of capital

market fluctuations on the net liability. The asset

port-

folio also includes equity instruments, property and

alternative investments – asset classes capable of gen-

erating

the higher rates of return necessary to cover

risks (such as changes in mortality tables) not taken into

account in the actuarial assumptions applied. The

financial risk of longer-than-assumed life expectancy is

hedged for the majority of participants of the BMW

Group’s largest pension plan in the UK by means of a

so-called “longevity hedge”.

In order to reduce currency exposures, a substantial

portion of plan assets are either invested in the same

currency as the underlying plan or hedged by means of

currency derivatives.

Pension fund assets are monitored continuously and

managed from a risk-and-yield perspective. Risk is re-

duced

by ensuring a broad spread of investments. In

this context, the BMW Group continuously monitors

the degree of coverage of pension plans as well as ad-

herence to the stipulated investment strategy.

As part of the internal reporting procedures and for

in-

ternal management purposes, financial risks relating

to the pension plans are reported on using a deficit-

value-at-risk approach. The investment strategy is also

subjected to regular review together with external

con-

sultants, with the aim of ensuring that investments are

Components of plan assets

Germany United Kingdom Other To t a l

in € million 2015 2014 2015 2014 2015 2014 2015 2014

Equity instruments 1,807 1,865 1,340 1,230 224 203 3,371 3,298

Debt instruments 4,834 4,509 4,623 4,562 420 379 9,877 9,450

thereof investment grade 3,525 3,271 4,437 4,331 383 334 8,345 7,936

thereof non-investment grade 1,309 1,238 186 231 37 45 1,532 1,514

Real estate – – – 3 20 – 20 3

Money market funds – – 255 100 19 12 274 112

Absolute return funds – – 33 26 – – 33 26

Other – – – 5 – – – 5

Total with quoted market price 6,641 6,374 6,251 5,926 683 594 13,575 12,894

Debt instruments 189 183 207 298 3 12 399 493

thereof investment grade 189 183 2 111 1 12 192 306

thereof non-investment grade – – 205 187 2 – 207 187

Real estate 172 107 783 683 105 105 1,060 895

Cash and cash equivalents 17 11 24 9 – – 41 20

Absolute return funds 554 424 705 557 34 – 1,293 981

Other 282 224 183 261 97 93 562 578

Total without quoted market price 1,214 949 1,902 1,808 239 210 3,355 2,967

31 December 7,855 7,323 8,153 7,734 922 804 16,930 15,861

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information