BMW 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103 GROUP FINANCIAL STATEMENTS

For machinery used in multiple-shift operations, depre-

ciation rates are increased to account for the additional

utilisation.

The cost of internally constructed plant and equipment

comprises all costs which are directly attributable to the

manufacturing process as well as an appropriate pro-

portion of production-related overheads. This includes

production-related depreciation and an appropriate

proportion of administrative and social costs.

As a general rule, borrowing costs are not included in

acquisition or manufacturing cost. Borrowing costs that

are directly attributable to the acquisition, construction

or production of a qualifying asset are recognised as a

part of the cost of that asset in accordance with IAS 23

(Borrowing Costs).

Non-current assets also include assets relating to leases.

The BMW Group uses property, plant and equipment as

lessee on the one hand and leases out vehicles produced

by the Group and other brands as lessor on the other.

IAS 17 (Leases) contains rules for determining, on the

basis of risks and rewards, the economic owner of the

assets.

In the case of finance leases, the assets are

at-

tributed to the lessee and in the case of operating leases

the assets are attributed to the lessor.

In accordance with IAS 17, assets leased under finance

leases are measured at their fair value at the inception of

the lease or at the present value of the lease payments,

if lower. The assets are depreciated using the straight-

line method over their estimated useful lives or over the

lease period, if shorter. The obligations for future lease

instalments are recognised as other financial liabili-

ties.

Where Group products are recognised by BMW Group

entities as leased products under operating leases, they

are measured at manufacturing cost. All other leased

products are measured at acquisition cost. All leased

products are depreciated over the period of the lease

using the straight-line method down to their expected

residual value. Changes in residual value expectations

are recognised – in situations where the recoverable

amount of the lease exceeds the asset’s carrying amount –

by adjusting scheduled depreciation prospectively over

the remaining term of the lease contract. If the recover-

able amount is lower than the asset’s carrying amount,

an impairment loss is recognised for the shortfall. A test

is carried out at each balance sheet date to determine

whether an impairment loss recognised in prior years no

longer exists or has decreased. In these cases, the carry-

ing amount of the asset is increased to the recoverable

amount. The higher carrying amount resulting from the

in years

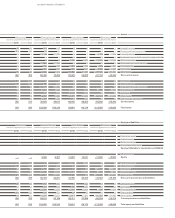

Factory and office buildings, residential buildings, fixed installations in buildings and outside facilities 8 to 50

Plant and machinery 3 to 21

Other equipment, factory and office equipment 2 to 25

Development costs for vehicle and engine projects

are capitalised at manufacturing cost, to the extent

that attributable costs can be measured reliably and

both technical feasibility and successful marketing

are assured. It must also be probable that the devel-

opment

expenditure will generate future economic

benefits. Capitalised development costs comprise all

expenditure that can be attributed directly to the de-

velopment

process, including development-related

overheads. Capitalised development costs are amor-

tised systematically over the estimated product life

(usually four to eleven years) following the start of

production.

Goodwill arises on first-time consolidation of an ac-

quired business when the cost of acquisition exceeds

the Group’s share of the fair value of the individually

identifiable assets acquired and liabilities and contin-

gent liabilities assumed.

All items of property, plant and equipment are consid-

ered to have finite useful lives. They are recognised at

acquisition or manufacturing cost less scheduled

de-

preciation based on the estimated useful lives of the

assets. Depreciation on property, plant and equipment

reflects the pattern of their usage and is generally com-

puted using the straight-line method. Components of

items of property, plant and equipment with different

useful lives are depreciated separately.

Systematic depreciation is based on the following useful

lives, applied throughout the BMW Group: