BMW 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160

44

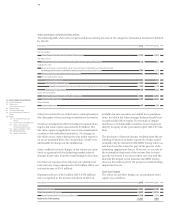

Related party relationships

In accordance with IAS 24 (Related Party Disclosures),

related individuals or entities which have the ability to

control the BMW Group or which are controlled by the

BMW Group, must be disclosed unless such parties

are

already included in the Group Financial Statements

of BMW AG as consolidated companies. Control is

de-

fined as ownership of more than one half of the voting

power of BMW AG or the power to direct, by statute or

agreement, the financial and operating policies of the

management of the BMW Group. In addition, the

dis-

closure requirements of IAS 24 also cover transactions

with associated companies, joint ventures and indi-

viduals that have the ability to exercise significant

in-

fluence

over the financial and operating policies of

the

BMW Group. This also includes close relatives and

intermediary entities. Significant influence over the

finan cial and operating policies of the BMW Group is

presumed when a party holds 20 % or more of the voting

power of BMW AG. In addition, the requirements con-

tained in IAS 24 relating to key management personnel

and close members of their families or intermediary

entities are also applied. In the case of the BMW Group,

this applies to members of the Board of Management

and Supervisory Board.

In the financial year 2015, the disclosure requirements

contained in IAS 24 affect the BMW Group with regard

to business relationships with non-consolidated sub-

sidiaries,

joint ventures and associated companies as

well as with members of the Board of Management and

Supervisory Board of BMW AG.

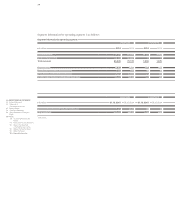

The BMW Group maintains normal business relation-

ships with non-consolidated subsidiaries. Transactions

with these companies are small in scale, arise in the

normal course of business and are conducted on the ba-

sis of arm’s length principles.

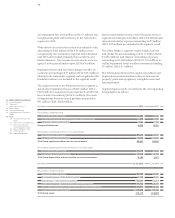

Transactions of BMW Group companies with the joint

venture BMW Brilliance Automotive Ltd., Shenyang, all

arise in the normal course of business and are conducted

on the basis of arm’s length principles. Group companies

sold goods and services to BMW Brilliance Automotive

Ltd., Shenyang, during the financial year under report

for an amount of € 4,815 million (2014: € 4,417 million).

At 31 December 2015, receivables of Group companies

from BMW Brilliance Automotive Ltd., Shenyang,

to-

talled € 892 million (2014: € 943 million). Trade and finan-

cial

payables of Group companies to BMW Brilliance

Automotive Ltd., Shenyang, amounted to € 107 million

(2014: € – million). Group companies received goods

and services from BMW Brilliance Automotive Ltd.,

Shenyang, in 2015 for an amount of € 43 million (2014:

€ 34 million).

All relationships of BMW Group entities with the joint

ventures DriveNow GmbH & Co. KG, Munich, and

DriveNow Verwaltungs GmbH, Munich, are conducted

on the basis of arm’s length principles. Transactions

with these entities arise in the normal course of business

and are small in scale.

Transactions of BMW Group companies with the asso-

ciated company THERE Holding B. V., Amsterdam, and

that entity’s subsidiaries, all arise in the normal course

of business and are conducted on the basis of arm’s

length principles. The BMW Group did not sell any goods

or services to THERE Holding B. V., Amsterdam, or its

subsidiaries during the period from 4 to 31 December

2015. Goods or services totalling € 7 million were

pur-

chased by BMW Group entities from THERE Holding

B. V., Amsterdam, during the period from 4 to 31 De-

cember 2015. At 31 December 2015, payables of BMW

Group entities to THERE Holding B. V., Amsterdam,

and that entity’s subsidiaries totalled € 3 million.

Business transactions between BMW Group entities and

other associated companies are small in scale, arise in

the normal course of business and are conducted on the

basis of arm’s length principles.

Stefan Quandt is a shareholder and Deputy Chairman of

the Supervisory Board of BMW AG. He is also the sole

shareholder and Chairman of the Supervisory Board of

amounts shown in the Group and segment balance

sheets.

Cash inflows and outflows relating to operating leases,

where the BMW Group is the lessor, are aggregated and

shown on the line “Change in leased products” within

cash flows from operating activities.

The net change in receivables from sales financing

(including finance leases, where the BMW Group is

the lessor) is also reported within cash flows from

operating activities.

Income taxes paid and interest received are classified

as cash flows from operating activities in accordance

with IAS 7.31 and IAS 7.35. Interest paid is presented

on a separate line within cash flows from financing

activities. Dividends received in the financial year 2015

amounted to € 1 million (2014: € 1 million).

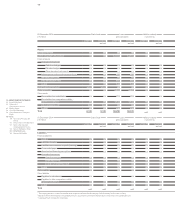

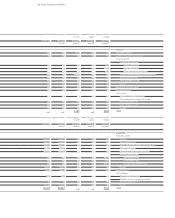

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information