BMW 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

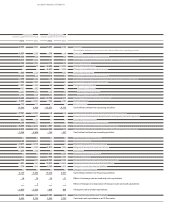

Consolidation principles

The equity of subsidiaries is consolidated in accordance

with IFRS 3 (Business Combinations). IFRS 3 requires

that all business combinations are accounted for using

the acquisition method, whereby identifiable assets and

liabilities acquired are measured at their fair value at

acquisition date. An excess of acquisition cost over the

Group’s share of the net fair value of identifiable assets,

liabilities and contingent liabilities is recognised as good-

will in a separate balance sheet line item and allocated

to the relevant cash-generating unit (CGU).

Receivables, payables, provisions, income and expenses

and profits between consolidated companies (intragroup

results) are eliminated on consolidation.

Joint operations and joint ventures are forms of joint

arrangements. Such an arrangement exists when the

BMW Group jointly carries out activities on the basis of

a contractual agreement with a third party that requires

the unanimous consent of both parties with respect to

all significant activities of the joint arrangement.

In the case of a joint operation, the parties that have

joint control of the arrangement have rights to the

assets, and obligations for the liabilities, relating to the

arrangement. Assets, liabilities, revenues and expenses

of a joint operation are recognised proportionately

in the Group Financial Statements on the basis of the

BMW Group’s rights and obligations.

4

Business acquisitions

In August 2015, BMW AG (Munich), Daimler AG

(Stutt-

gart) and AUDI AG (Ingolstadt) agreed with Nokia

Corporation, Helsinki, to acquire that entity’s maps and

location-based services business (HERE Group), as part

of a joint strategy to secure the long-term availability of

HERE’s products and services as an open, independent

and value-creating platform for cloud-based maps and

other mobility services.

The HERE Group’s digital maps are fundamental for the

next generation of mobility and location-based services,

providing the basis for new assistance systems and, ulti-

mately,

fully autonomous driving. Using high-precision

digital maps in combination with real-time vehicle data,

it will be possible to increase road safety and facilitate the

development of innovative new products and services.

THERE Holding B. V., Amsterdam, and its wholly owned

subsidiary, HERE International B. V., Amsterdam (until

28 January 2016: THERE Acquisition B. V., Amsterdam)

were founded in connection with the acquisition. HERE

International B. V., Amsterdam, acquired all of the shares

of the HERE Group. Via BMW International Holding

pany. Furthermore, the non-consolidated entity, BMW

Forschung und Technik GmbH, Munich, was merged

with BMW AG.

B. V., The Hague, the BMW Group has a 33.3 % share-

holding

in THERE Holding B. V., Amsterdam.

BMW, AUDI and Daimler jointly acquired HERE’s

map-

ping service with effect from 4 December 2015. Out of

the total purchase price of € 2.6 billion (subject to

pur-

chase price adjustments), an amount of € 0.6 billion was

financed via bank loans taken up by the intermediary

acquiring entity. The remainder is being financed by the

three partners in equal parts. The BMW Group’s share

of this amount was approximately € 0.67 billion.

THERE Holding B. V., Amsterdam, is included in the

BMW AG Group Financial Statements as an associated

company using the equity method and allocated for

segment reporting purposes to the Automotive segment.

In view of the proximity of the reporting date and on

the grounds of materiality, no fair value adjustments

were recorded in conjunction with the at-equity carry-

ing amount at 31 December 2015, with the consequence

that the Group’s interest is accounted for at cost at that

date. The purchase price allocation is expected to be com-

pleted

in the first quarter of 2016.

THERE Holding B. V., Amsterdam, is included in the

BMW AG Group Financial Statements for the year

ended 31 December 2015 as an associated company using

the equity method (see also note 3).

3

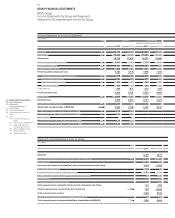

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information