BMW 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

Opportunities management system and

identifying opportunities

New opportunities regularly present themselves in the

dynamic business environment in which the BMW

Group operates. General economic trends and sector-

specific factors – including external regulations, sup-

pliers, customers and competitors – are monitored on a

continuous basis. Identifying opportunities is an integral

part of the process of developing strategies and drawing

up forecasts for the BMW Group.

The Group’s product and service portfolio is continually

reviewed on the strength of these analyses and new

product projects are presented to the Board of Manage-

ment for consideration, as deemed appropriate.

The continuous improvement of important business pro-

cesses

and strict cost controls are essential in the Group’s

ongoing endeavours to ensure good profitability and

(net of appropriate countermeasures) and its likelihood

of occurrence in each case. The amount of a risk is ap-

proximated in the case of risks measured on the basis of

“value-at-risk” and “cash-flow-at-risk” models. In this

situation, the following assessment criteria are applied:

a high return on capital employed. Any profitability im-

provement measures likely to be implemented are in-

corporated in the forecast. One example is the imple-

mentation of modular-based production and common

architectures, which enable a greater commonality of

features between different models and product lines.

This strategy, in turn, contributes to improved profita-

bility by reducing development costs and other invest-

ment

on the series development of new vehicles. The

new approach helps cut production costs and increase

production flexibility. Moreover, a more competitive cost

basis opens up opportunities to engage in new market

segments.

The implementation of identified opportunities is un-

dertaken on a decentralised basis. The significance

of opportunities for the BMW Group is classified in

the

categories “material” or “not material”.

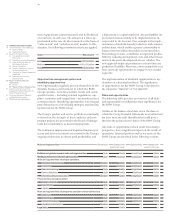

Risks and opportunities

The following table provides an overview of all risks

and opportunities and illustrates their significance for

the BMW Group.

Neither at the balance sheet date nor at the date on

which the Group Financial Statements were authorised

for issue were any risks identified that could pose a

threat to the going-concern status of the BMW Group.

Any risks or opportunities which could, from today’s

perspective, have a significant impact on the results of

operations, financial position and / or net assets of the

BMW Group are described in the following sections.

Class Risk amount

Low > €0 – 50 million

Medium > €50 – 400 million

High > €400 million

Risks and opportunities Risk amount

Change com-

Opportunities

Change com-

pared to prior year pared to prior year

Political and global economic risks and opportunities High Stable Insignificant Stable

Strategic and sector risks and opportunities High Increased Insignificant Stable

Risks and opportunities relating to operations

Production and technology Medium Stable Insignificant Stable

Purchasing Medium Reduced Insignificant Stable

Sales and marketing High Stable Insignificant Stable

Pension obligations High Stable Significant Stable

Information, data protection and IT

Medium Stable Insignificant Stable

Financial risks and opportunities

Foreign currencies High Stable Significant Stable

Raw materials High Stable Significant Stable

Liquidity Low Stable – –

Risks and opportunities relating to the provision of financial services

Credit risk High Stable Significant Stable

Residual value High Stable Significant Stable

Interest rate changes High Increased Significant Stable

Liquidity / operational risks Medium Stable – –

Legal risks Low Stable – –