BMW 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

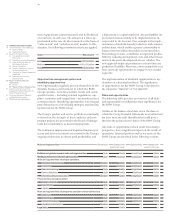

Risks arising from the tightening of laws and regulations

One of the greatest risks for the automobile industry is

the possible threat of short-term tightening of laws

and

regulations, as they could give rise to significantly

higher levels of investment and ongoing expenses, and

perhaps more importantly, result in changes in cus-

tomer

behaviour. The potential tightening of consumer

protection laws could also result in a greater number of

recalls. In some cases, changes in customer behaviour

are not only brought on by new regulations, but also

through changes in public opinion, values, environmen-

tal issues and fuel / energy prices. There is a clear move

towards increasingly stringent vehicle emissions regu-

lations,

particularly for conventional drive systems, not

only in the developed markets of Europe and North

America, but also in emerging markets such as China.

The BMW Group counters this risk with its Efficient

Dynamics technology and continues to play a pioneering

role in the premium segment by continually reducing

both fuel consumption and emissions. Since 2013, elec-

tric drive systems built into BMW i vehicles have in-

creasingly broadened the mix on offer, thus bolstering

the BMW Group’s efforts to comply with statutory car-

bon emissions regulations and requirements. The BMW

Group is investing in the development of sustainable

drive technologies and materials, with the aim of

pro-

viding highly efficient vehicles for individual mobility in

the premium segment, both now and in the future.

Further significant risks could be triggered by the

tight

ening of existing import and export regulations,

re-

sulting primarily in additional expenses, but also in re-

strictions in the import and export of vehicles and / or

parts. Changes in the legal business environment are

monitored and assessed regularly by the relevant central-

ised

departments, thus ensuring that the BMW Group

always complies with statutory requirements. The impact

of legislation that has either been enacted or is likely to

be enacted is taken into account in the outlook.

Employees make a vital contribution to sustainable

growth and improved profitability through their innova-

tive skills. One prerequisite in this regard is a consistent

strategic approach to the management of human

re-

sources, even in the event of changes in the legal frame-

work. The BMW Group has put appropriate measures in

place for such eventualities. Risk amounts and earnings

impact in this category are measured on the basis of ex-

tensive scenario analyses.

If strategic and sector category risks were to materialise,

they could have a high earnings impact over the two-

year assessment period. The amounts of risk attached to

strategic and sector-specific risks are classified as high.

Strategic and sector opportunities

Additions to the product and mobility portfolio and

ex-

pansion in growth regions are seen as the most im-

portant

opportunities for growth in the medium to long

term.

Remaining on growth course depends above all on the

ability to develop innovative products and bring them

to market. The introduction of the BMW i brand opens

up new customer target groups for the Group and con-

solidates the position of BMW as a sustainable, forward-

looking brand. BMW i products can be seen as “empower-

ment projects” for new technologies and processes, which

may also benefit other vehicle concepts. The existing

product portfolio has been expanded to include mobility

services such as DriveNow, ChargeNow and ParkNow.

In 2015, the BMW Group entered new segments with

the BMW 2 Series Active Tourer and the 2 Series Gran

Tourer. The market acceptance and sales volumes of

product innovations that are either planned for the future

or have recently been launched could turn out to be

greater than predicted in the outlook. In the short term,

however, any potentially positive impact is classified as

insignificant

.

The long-term trend towards greater sustainability pro-

vides opportunities to boost sales of sustainable products

and, under the right circumstances, achieve better sell-

ing prices. Innovations such as the BMW i 3 and i8 in the

field of electric mobility or Efficient Dynamics across the

entire product portfolio provide excellent platforms for

future growth. Potential also exists in engaging in new

product and market categories and developing new cus-

tomer target groups. New business models and coopera-

tion

arrangements with the BMW Group’s growing

network of business partners often provide the best

means to exploit these opportunities. Good examples

are the implementation of the 360° ELECTRIC portfolio

in the field of electric mobility, the partnership with

Sixt in the field of mobility services, and collaboration

with Toyota on developing a hydrogen fuel cell system.

The BMW Group is constantly refining the tools it uses

to recruit staff, encourage career development and re-

tain employees within the Group. This environment of-

fers people the ideal situation in which to develop their

skills. If these measures generate greater benefits than

currently expected, the BMW Group’s revenues, results

of operations and cash flows can be positively impacted