BMW 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166

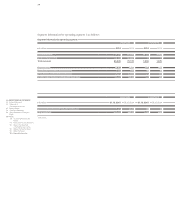

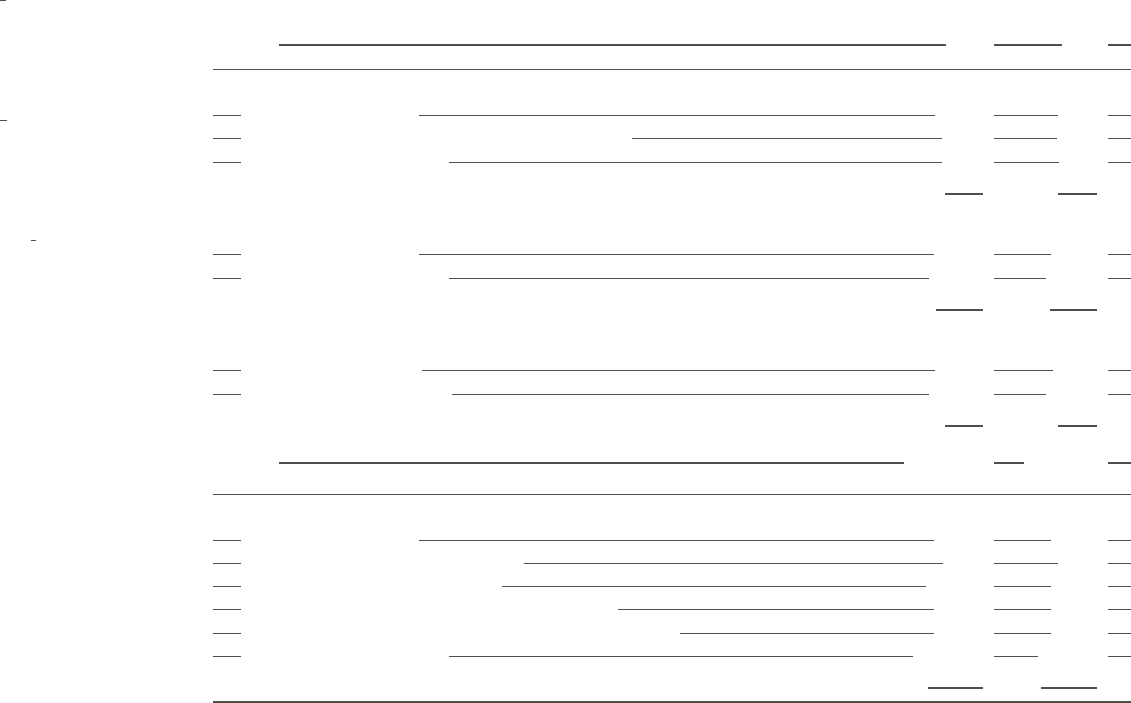

in € million 2015 2014

Reconciliation of segment result

Total for reportable segments 10,204 9,233

Financial result of Automotive segment and Motorcycles segment – 316 – 363

Elimination of inter-segment items – 664 – 163

Group profit before tax 9,224 8,707

Reconciliation of capital expenditure on non-current assets

Total for reportable segments 29,573 25,297

Elimination of inter-segment items – 5,672 – 4,621

Total Group capital expenditure on non-current assets 23,901 20,676

Reconciliation of depreciation and amortisation on non-current assets

Total for reportable segments 13,314 11,683

Elimination of inter-segment items – 5,119 – 4,112

Total Group depreciation and amortisation on non-current assets 8,195 7,571

in € million 31. 12. 2015 31. 12. 2014

Reconciliation of segment assets

Total for reportable segments 92,238 82,937

Non-operating assets – Other Entities segment 7,132 6,658

Total liabilities – Financial Services segment 112,081 96,959

Non-operating assets – Automotive and Motorcycles segments 41,932 39,449

Liabilities of Automotive and Motorcycles segments not subject to interest 31,817 28,488

Elimination of inter-segment items – 113,026 – 99,688

Total Group assets 172,174 154,803

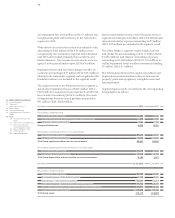

An impairment loss of € 3 million (2014: € – million) was

recognised on plant and machinery in the Automotive

segment in 2015.

Write-downs on inventories to their net realisable value

amounting to € 486 million (2014: € 29 million) were

recognised by the Automotive segment in the financial

year 2015 and resulted primarily from accidents and

natural disasters. No reversals of write-downs were rec-

ognised in the period under report (2014: € 3 million).

Impairment losses and fair value changes on other in-

vestments amounting to € 17 million (2014: € 153 million)

relating to the Automotive segment and recognised in the

financial result are not included in the segment result.

The segment result of the Financial Services segment is

stated after impairment losses of € 406 million (2014:

€ 268 million) recognised on leased products and € 3 mil-

lion on other investments (2014: € – million). Reversals

of impairment losses on leased products amounted to

€ 81 million (2014: € 169 million).

Interest and similar income of the Financial Services

segment amounting to € 4 million (2014: € 4 million) and

interest and similar expenses amounting to € 7 million

(2014: € 29 million) are included in the segment result.

The Other Entities’ segment result includes interest

and similar income amounting to € 1,177 million (2014:

€ 1,295 million) and interest and similar expenses

amounting to € 1,080 million (2014: € 1,197 million) as

well as impairment losses on other investments totalling

€ 7 million (2014: € – million).

The information disclosed for capital expenditure and

depreciation and amortisation relates to non-current

property, plant and equipment, intangible assets and

leased products.

Segment figures can be reconciled to the corresponding

Group figures as follows:

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information