BMW 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

37

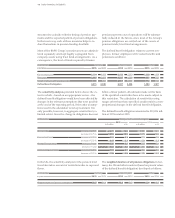

Income tax liabilities

Income tax liabilities totalling € 1,441 million (2014:

€ 1,590 million) include obligations amounting to

€ 485 million (2014: € 956 million) which are expected

to

be settled after more than twelve months. Some of

the liabilities may be settled earlier than this depend-

ing on the timing of proceedings.

Current tax liabilities of € 1,441 million (2014: € 1,590 mil-

lion) comprise € 288 million (2014: € 151 million) for

taxes payable and € 1,153 million (2014: € 1,439 million)

for tax provisions. Tax provisions totalling € 8 million

were reversed in the year under report (2014: € 1 mil-

lion).

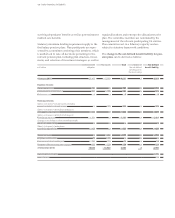

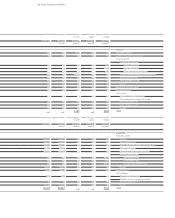

in € million

1. 1. 2015

Translation

Additions

Reversal of

Utilised Reversed 31. 12. 2015

differences

discounting

Obligations for personnel and social expenses 1,871 7 1,496 1 – 1,414 – 22 1,939

Obligations for ongoing operational expenses 4,887 283 3,462 72 – 2,474 – 419 5,811

Other obligations 2,032 54 677 2 – 604 – 281 1,880

Other provisions 8,790 344 5,635 75 – 4,492 – 722 9,630

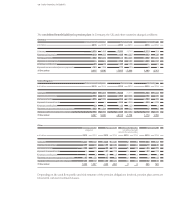

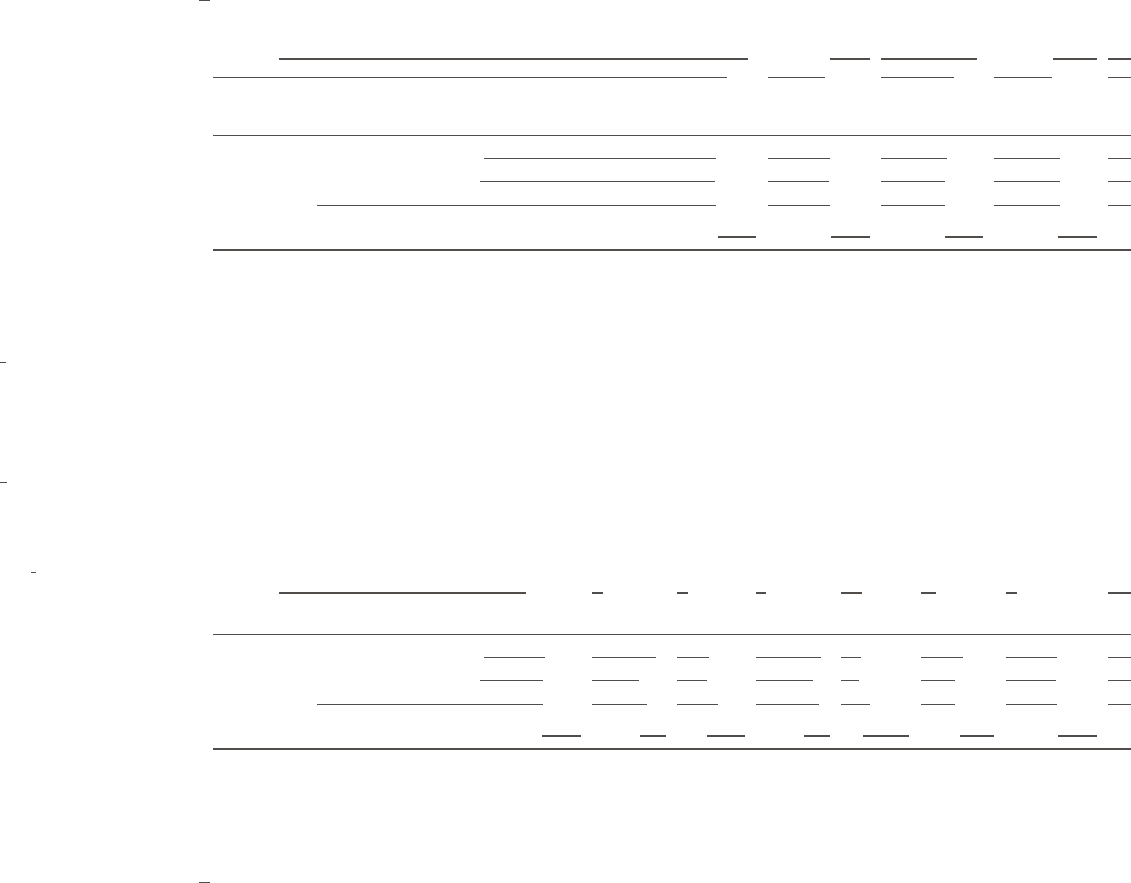

in € million 31. 12. 2015 31. 12. 2014

To t a l thereof To t a l thereof

due within due within

one year one year

Obligations for personnel and social expenses 1,939 1,475 1,871 1,442

Obligations for ongoing operational expenses 5,811 2,430 4,887 1,786

Other obligations 1,880 1,104 2,032 1,294

Other provisions 9,630 5,009 8,790 4,522

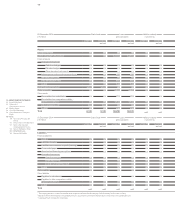

36

Other provisions

Other provisions comprise the following items:

Provisions for obligations for personnel and social

ex-

penses comprise mainly performance-related remunera-

tion

components, early retirement part-time working

arrangements and employee long-service awards. Obliga-

tions

for performance-related remuneration components

are normally settled in the following financial year.

Provisions for obligations for ongoing operational ex-

penses relate primarily to warranty obligations and

comprise both statutorily prescribed manufacturer

warranties and other guaranties offered by the BMW

Group. Depending on when claims are made, it is

possible that the BMW Group may be called upon to

fulfil obligations over the whole period of the war-

ranty or guarantee. Expected reimbursement claims

amounted to € 711 million at the end of the reporting

period (2014: € 641 million). Also included are other

provisions for expected payments for bonuses, rebates

and other price deductions.

Provisions for other obligations cover numerous specific

risks and obligations of uncertain timing and amount,

in particular for litigation and liability risks.

Other provisions changed during the year as follows:

Income from the reversal of other provisions amounting to € 550 million (2014: € 198 million) is recorded in cost of

sales and in selling and administrative expenses.

to measure the level of funding. In conjunction with

these valuations, funding plans are drawn up and the

amount of any necessary special allocations determined.

Statutory minimum funding and recovery requirements

apply in the UK and the USA which may have an effect

on future amounts. Valuations are performed regularly

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

113 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

147 Other Disclosures

163 Segment Information