BMW 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

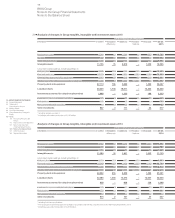

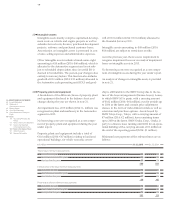

115 GROUP FINANCIAL STATEMENTS

in € million 2015 2014

Current tax expense 2,751 2,774

Deferred tax expense 77 116

Income taxes 2,828 2,890

in € million 2015 2014

Income from investments in subsidiaries and participations 1 3

thereof from subsidiaries: € – million (2014: € 2 million)

Impairment losses on investments in subsidiaries and participations – 25 – 153

Result on investments – 24 – 150

Losses and gains relating to financial instruments – 430 – 597

Sundry other financial result – 430 – 597

Other financial result – 454 – 747

16

15

Other financial result

Income taxes

Taxes on income comprise the following:

The result on investments for the year under report

includes impairment losses on other investments total-

ling € 25 million (2014: € 153 million). In the previous

year, this line item was influenced by an impairment

loss of € 152 million recognised on the investment in

SGL Carbon SE, Wiesbaden.

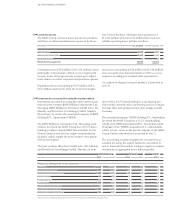

Current tax expense includes € 164 million (2014:

€ 275 million) relating to prior periods.

A deferred tax expense of € 52 million (2014: € 83 mil-

lion) is attributable to new temporary differences and

the reversal of temporary differences brought forward.

The tax expense was reduced by € 64 million (2014:

€ 27 million) as a result of utilising tax losses / tax credits

brought forward, for which deferred assets had not

previously been recognised.

The change in the valuation allowance on deferred tax

assets relating to tax losses available for carryforward

and temporary differences resulted in a tax expense of

€ 105 million (2014: € 49 million).

Deferred taxes are computed using enacted or planned

tax rates which are expected to apply in the relevant

The improvement in other financial result was primarily

attributable to the lower net negative impact arising on

currency derivatives.

national jurisdictions when the amounts are recovered.

A uniform corporation tax rate of 15.0 % plus solidarity

surcharge of 5.5 % applies in Germany, giving a tax rate

of

15.8 %, unchanged from the previous year. After taking

account of an average municipal trade tax multiplier rate

(Hebesatz) of 425.0 % (2014: 425.0 %), the municipal trade

tax rate for German entities is 14.9 % (2014: 14.9 %). The

overall income tax rate in Germany is therefore 30.7 %

(2014: 30.7 %). Deferred taxes for non-German entities

are calculated on the basis of the relevant country-spe-

cific tax rates and remained in a range of between 12.5 %

and 46.9 %. Changes in tax rates resulted in a deferred

tax expense of € 36 million (2014: € 22 million).

The actual tax expense for the financial year 2015 of

€ 2,828 million (2014: € 2,890 million) is € 4 million

(2014: € 217 million higher) lower than the expected tax

expense of € 2,832 million (2014: € 2,673 million) which

would theoretically arise if the tax rate of 30.7 %