BMW 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

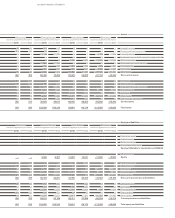

101 GROUP FINANCIAL STATEMENTS

Accounting policies

The financial statements of BMW AG and of its subsidi-

aries in Germany and elsewhere have been prepared for

consolidation purposes using uniform accounting poli-

cies in accordance with IFRS 10 (Consolidated Financial

Statements).

Revenues from the sale of products are recognised

when the risks and rewards of ownership of the goods

are transferred to the dealer or customer, provided that

the amount of revenue can be measured reliably, it is

probable that the economic benefits associated with the

transaction will flow to the entity and costs incurred or

to be incurred in respect of the sale can be measured

reliably. Revenues are stated net of settlement discount,

bonuses and rebates. Revenues also include lease rentals

and interest income earned in conjunction with

finan-

cial services. Revenues from leasing instalments relate

to operating leases and are recognised in the income

statement on a straight line basis over the relevant term

Investments accounted for using the equity method

(joint ventures and associated companies) are meas-

ured at the BMW Group’s share of equity, taking

account of fair value adjustments. Any difference be-

tween the cost of investment and the Group’s share of

equity is accounted for in accordance with the acquisi-

tion method. Investments in other companies are

ac-

Foreign currency translation

The financial statements of consolidated companies

which are drawn up in a foreign currency are translated

using the functional currency concept (IAS 21 The

Effects of Changes in Foreign Exchange Rates) and the

modified closing rate method. The functional currency

of a subsidiary is determined as a general rule on the

basis of the primary economic environment in which it

operates and corresponds therefore usually to the rele-

vant local currency. Income and expenses of foreign

subsidiaries are translated in the Group Financial

State-

ments at the average exchange rate for the year, and

assets and liabilities are translated at the closing rate.

Exchange differences arising from the translation of

shareholders’ equity are recognised directly in

accumu-

lated other equity. Exchange differences arising from

the

use of different exchange rates to translate the income

counted for as a general rule using the equity method

when significant influence can be exercised (IAS 28

Investments in Associates and Joint Ventures). As a

general rule, there is a rebuttable assumption that the

Group has significant influence if it holds between 20 %

and 50 % of the associated company’s or joint venture’s

voting power.

statement are also recognised directly in accumulated

other equity.

Foreign currency receivables and payables in the single

entity accounts of BMW AG and subsidiaries are

re-

corded, at the date of the transaction, at cost. At the end

of the reporting period, foreign currency receivables

and payables are translated at the closing exchange rate.

The resulting unrealised gains and losses as well as the

subsequent realised gains and losses arising on settle-

ment are recognised in the income statement in

accord-

ance with the underlying substance of the relevant

transactions.

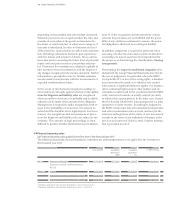

The exchange rates of those currencies which have a

material impact on the Group Financial Statements

were as follows:

Closing rate Average rate

31.12. 2015 31.12. 2014 2015 2014

US Dollar 1.09 1.21 1.11 1.33

British Pound 0.74 0.78 0.73 0.81

Chinese Renminbi 7.07 7.53 6.97 8.19

Japanese Yen 130.74 144.95 134.28 140.38

Russian Rouble 79.91 70.98 68.01 51.03

Korean Won 1,278.92 1,324.84 1,255.38 1,397.80

5

6