BMW 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 COMBINED MANAGEMENT REPORT

Cash outflows for operating activities in the Financial

Services segment are driven primarily by cash flows re-

lating to leased products and receivables from sales fi-

nancing and totalled € 10,351 million (2014: € 4,715 mil-

lion). Overall, cash outflows from investing activities

totalled € 140 million (2014: € 297 million). Cash inflows

Refinancing

A broadly based range of instruments transacted on in-

ternational money and capital markets is used to refi-

nance worldwide operations. Practically all of the funds

raised are used to finance the BMW Group’s Financial

Services business.

The overall objective of Group financing is to ensure the

solvency of the BMW Group at all times. Achieving this

objective is tackled in three strategic areas:

1. The ability to act at all times by assuring permanent

access to strategically important capital markets,

2. Autonomy through the diversification of refinancing

instruments and investors, and

3. Focus on value by optimising financing costs.

liquidity planning, the excess amount was € 5,404 mil-

lion (2014: € 3,481 million).

from financing activities went up by € 4,101 million to

€ 10,028 million, mainly influenced by the change in

other financial liabilities.

Net financial assets of the Automotive segment comprise

the following:

Financing measures undertaken centrally ensure access

to liquidity for the Group’s operating subsidiaries on

market-based and consistent conditions. Funds are ac-

quired with a view to achieving a desired structure for

the composition of liabilities, comprising a finely tuned

mix of financing instruments. The use of longer-term

financing instruments to finance the Group’s financial

services business and the maintenance of a sufficiently

high liquidity reserve serves to avoid the liquidity risk

intrinsic to any large portfolio of contracts. This prudent

approach to financing also bolsters BMW AG’s ratings.

Further information is provided in the “Liquidity risks”

section of the “Report on outlook, risks and opportu-

nities”.

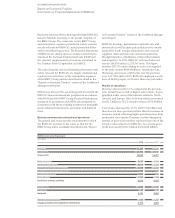

Free cash flow for the Automotive segment was as

follows:

in € million 2015 2014

Cash inflow from operating activities 11,836 9,423

Cash outflow from investing activities – 7,524 – 5,836

Net investment in marketable securities and term deposits 1,092 – 106

Free cash flow Automotive segment 5,404 3,481

in € million 31.12. 2015 31.12. 2014

Cash and cash equivalents 3,952 5,752

Marketable securities and investment funds 4,326 3,366

Intragroup net financial assets 11,278 8,583

Financial assets 19,556 17,701

Less: external financial liabilities* – 2,645 – 3,478

Net financial assets Automotive segment 16,911 14,223

* Excluding derivative financial instruments.