BMW 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Report on Risks and Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

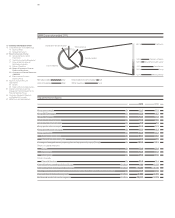

(2014: 20.7 %) and the Africa, Asia and Oceania region

for 31.1 % (2014: 32.5 %) of business.

External revenues in Germany edged up by 3.1 %. In

the Rest of Europe region and in the Americas region, ex-

ternal

revenues increased by 16.2 % and 29.4 %

respec-

tively. Good contributions to the increase in Europe were

made by Great Britain, France, Spain and Italy. Reve-

nues in the Africa, Asia and Oceania region grew 9.6 %

to € 28,648 million (2014: € 26,147 million). Particularly

in China and South Korea, revenues increased on the

back of higher sales volume figures and favourable cur-

rency factors.

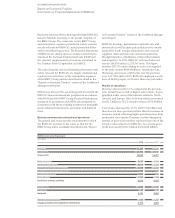

The Group’s cost of sales was 16.8 % higher year-on-

year, due to sales volume and currency factors. This

line item mainly comprises manufacturing costs (2015:

€ 43,685 million; 2014: € 38,253 million), the cost of

sales directly attributable to financial services (2015:

€ 17,407 million; 2014: € 14,716 million) and research and

development expenses (2015: € 4,271 million; 2014:

€ 4,135 million).

Gross profit improved by 6.6 % to € 18,132 million, re-

sulting in a gross profit margin of 19.7 % (2014: 21.2 %).

The Automotive segment recorded a gross profit mar-

gin of 17.7 % (2014: 18.6 %), while that of the Motor-

cycles segment rose from 18.7 % to 22.5 %. In the Finan-

cial Services segment, the gross profit margin came in

at 13.3 % (2014: 13.7 %).

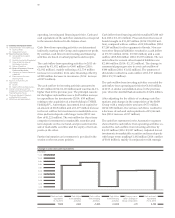

Compared to the previous year, research and develop-

ment expenses increased by € 136 million to € 4,271 mil-

lion. As a percentage of revenues, the research and de-

velopment ratio fell by 0.5 percentage points to 4.6 %.

Research and development expenses include amortisa-

tion

of capitalised development costs amounting to

€ 1,166 million (2014: € 1,068 million). Total research and

development expenditure – comprising research costs,

non-capitalised development costs and capitalised

de-

velopment costs (excluding systematic amortisation

thereon) – amounted to € 5,169 million (2014: € 4,566 mil-

lion). The research and development expenditure ratio

was therefore 5.6 % (2014: 5.7 %). The proportion of

development costs recognised as assets was 39.9 % (2014:

32.8 %).

Compared to the previous year, selling and

administra-

tive expenses increased by € 741 million to € 8,633 million

.

Overall, selling and administrative expenses were

equivalent

to 9.4 % (2014: 9.8 %) of revenues. Adminis-

trative expenses increased due to a number of factors,

including the increased size of the workforce and

higher expenses for new IT projects. Depreciation and

amortisation on property, plant and equipment and

intangible assets recorded in cost of sales and in selling

and administrative expenses amounted to € 4,659 mil-

lion (2014: € 4,170 million).

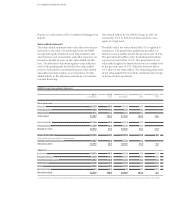

The net positive amount from other operating income

and expenses improved from € 5 million to € 94 mil-

lion,

mainly reflecting gains on the sale of marketable

securities.

Profit before financial result (EBIT) amounted to

€ 9,593 million

(2014: € 9,118 million).

The financial result for the twelve-month period was a

net negative amount of € 369 million, an improvement

of € 42 million compared to the previous year. The

result from equity-accounted investments, comprising

the

Group’s share of the results of the joint ventures

BMW Brilliance Automotive Ltd., Shenyang, DriveNow

GmbH & Co. KG, Munich, and DriveNow Verwaltungs

GmbH, Munich, fell by € 137 million to € 518 million.

The net interest expense also deteriorated year-on-year,

rising by € 114 million to € 433 million. This increase

was partly attributable to higher net interest expenses

from defined benefit pension plans. Other financial

result in 2015 was a negative amount of € 454 million,

mostly arising in connection with the fair value meas-

urement of currency and commodity derivatives.

Com-

pared to the previous year, other financial result im-

proved by € 293 million, mainly thanks to the lower

negative impact of currency derivatives. In the previous

year, impairment losses recognised on other investments,

most notably on the investment in SGL Carbon SE,

Wiesbaden, had also negatively impacted other finan-

cial result.

Profit before tax increased to € 9,224 million (2014:

€ 8,707 million). The pre-tax return on sales was 10.0 %

(2014: 10.8 %).

Income tax expense amounted to € 2,828 million

(2014: € 2,890 million), corresponding to an effective

tax rate of 30.7 % (2014: 33.2 %). The lower income tax

expense for the twelve-month period was partly due

to the changed regional earnings mix as well as inter-

group pricing issues.

Earnings performance by segment

Revenues of the Automotive segment grew by 13.8 % to

€ 85,536 million on the back of higher sales volume

and the positive currency impact. Adjusted for exchange