BMW 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51 COMBINED MANAGEMENT REPORT

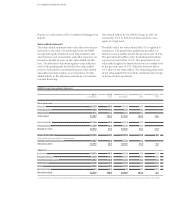

rate factors, the increase was 6.3 %. The gross profit

margin was at a similar level to the

previous year at

17.7 % (2014: 18.6 %).

Compared to the previous year, selling and administra-

tive expenses increased by € 574 million to € 7,219

mil-

lion. Administrative expenses increased due to a number

of factors, including the increased size of the workforce

and higher expenses for new IT projects. Overall, selling

and administrative expenses were equivalent to 8.4 %

(2014: 8.8 %) of revenues.

Other operating income and expenses deteriorated by

€ 19 million to a net expense of € 82 million.

Profit before financial result (EBIT) amounted to

€ 7,836 million (2014: € 7,244 million), giving an EBIT

margin of 9.2 % (2014: 9.6 %).

The financial result of the Automotive segment was a

net negative amount of € 313 million, an improvement

of € 45 million compared to the previous year. The result

from equity-accounted investments, comprising the

segment’s share of the results of the BMW Brilliance

Automotive Ltd., Shenyang, joint venture and the two

DriveNow entities, was € 137 million lower than one

year earlier. The interest result for the year deteriorated

by € 146 million to a net expense of € 435 million. This

was partly attributable to higher net interest expenses

from defined benefit pension plans. Other financial

result in 2015 was a negative amount of € 396 million,

mostly arising in connection with the fair value meas-

urement of currency and commodities derivatives.

Compared to the previous year, other financial result

improved by € 328 million, mainly thanks to the lower

negative impact of currency derivatives. In the previous

year, impairment losses recognised on other investments,

most notably on the investment in SGL Carbon SE,

Wiesbaden, had also negatively impacted other finan-

cial result.

Overall, the Automotive segment reports a solid rise in

profit before tax to € 7,523 million (2014: € 6,886 million).

Motorcycles segment revenues were 18.5 % up on the

previous year. Adjusted for exchange rate factors, the in-

crease was 15.4 %.

Segment profit before tax improved by € 72 million to

€ 179 million on the back of higher sales volume.

Financial Services segment revenues grew by 15.2 % to

€ 23,739 million. Adjusted for exchange rate factors, rev-

enues went up by 7.6 %. The segment’s revenue perfor-

mance primarily reflects the growth of its contract

port-

folio. The gross profit margin, at 13.3 %, was roughly

in line with the previous year (2014: 13.7 %). Selling and

administrative expenses were € 129 million higher at

€ 1,164 million. Other operating income and expenses

improved by € 17 million to a net expense of € 8 million.

Overall, the Financial Services segment reports profit

before tax of € 1,975 million, 14.6 % up on the previous

year (2014: € 1,723 million).

Profit before tax in the Other Entities segment, at

€ 211 million, was € 57 million higher than one year

earlier.

The negative impact on earnings at the level of profit be-

fore tax reported in the Eliminations column increased

from € 163 million in 2014 to € 664 million in 2015,

mainly due to an increase in new leasing business and

changes in the leased products portfolio. The previous

year’s figures had also benefited from elimination re-

versal effects.

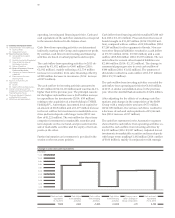

Financial position

The consolidated cash flow statements for the Group and

the Automotive and Financial Services segments show

the sources and applications of cash flows for the finan-

cial years 2015 and 2014, classified into cash flows from

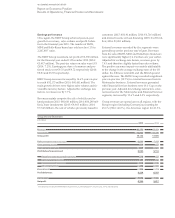

Revenues by segment

in € million

2015 2014

Automotive 85,536 75,173

Motorcycles 1,990 1,679

Financial Services 23,739 20,599

Other Entities 7 7

Eliminations – 19,097 – 17,057

Group 92,175 80,401

Profit / loss before tax by segment

in € million

2015 2014

Automotive 7,523 6,886

Motorcycles 179 107

Financial Services 1,975 1,723

Other Entities 211 154

Eliminations – 664 – 163

Group 9,224 8,707