BMW 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133 GROUP FINANCIAL STATEMENTS

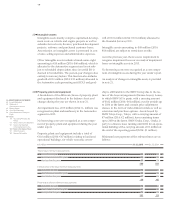

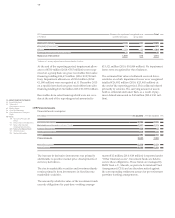

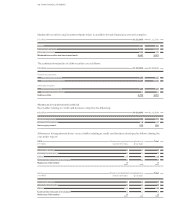

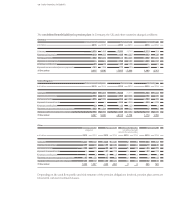

in € million 31. 12. 2015 31. 12. 2014

Equity attributable to shareholders of BMW AG 42,530 37,220

Proportion of total capital 31.7 % 31.6 %

Non-current financial liabilities 49,523 43,167

Current financial liabilities 42,160 37,482

Total financial liabilities 91,683 80,649

Proportion of total capital 68.3 % 68.4 %

Total capital 134,213 117,869

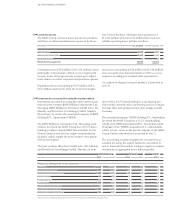

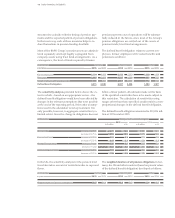

equity). Other miscellaneous changes reduced revenue

reserves by € 71 million (2014: € – million).

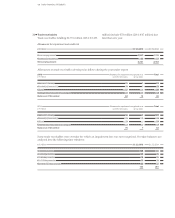

The unappropriated profit of BMW AG at 31 December

2015 amounts to € 2,102 million and will be proposed

to

the Annual General Meeting for distribution. This

amount includes € 175 million relating to preferred stock.

The amount proposed for distribution represents an

amount of €3.22 per share of preferred stock and €3.20

per share of common stock. The proposed distribution

must be authorised by the shareholders at the Annual

General Meeting of BMW AG. It is therefore not recog-

nised

as a liability in the Group Financial Statements.

Accumulated other equity

Accumulated other equity comprises all amounts

recog-

nised directly in equity resulting from the translation

of

the financial statements of foreign subsidiaries, the

effects of recognising changes in the fair value of deriva-

tive

financial instruments and marketable securities

directly in equity and the related deferred taxes recog-

nised directly in equity.

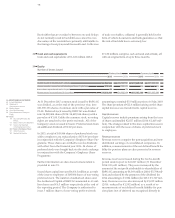

Minority interests

Equity attributable to minority interests amounted to

€ 234 million (2014: € 217 million). This includes a mi-

nority interest of € 27 million in the results for the year

(2014: € 19 million).

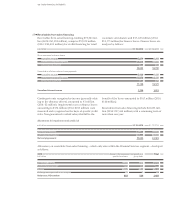

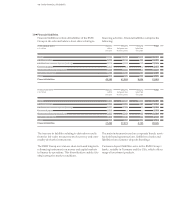

Capital management disclosures

The BMW Group’s objectives when managing capital

are to safeguard the Group’s ability to continue as a

going

concern in the long-term and to provide an ade-

quate return to shareholders.

The BMW Group manages the capital structure and

makes

adjustments to it in the light of changes in eco-

nomic conditions and the risk profile of the underlying

assets.

The BMW Group is not subject to any external minimum

equity capital requirements. Within the Financial

Ser-

vices segment, however, there are a number of individual

entities which are subject to equity capital requirements

set by regulatory banking agencies.

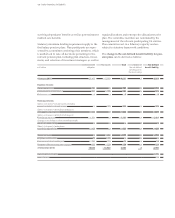

In order to manage its capital structure, the BMW Group

uses various instruments including the amount of divi-

dends paid to shareholders and share buy-backs.

Moreover, the BMW Group pro-actively manages debt

capital, determining levels of debt capital transactions

with a target debt structure in mind. An important as-

pect

of the selection of financial instruments is the ob-

jective

to achieve matching maturities for the Group’s

financing requirements. In order to reduce non-sys-

tematic

risk, the BMW Group uses a variety of financial

instruments available on the world’s capital markets to

achieve diversification.

The capital structure at the end of the reporting period

was as follows: