BMW 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

23 Report on Economic Position

23 General and Sector-specific

Environment

27 Overall Assessment by Management

27 Financial and Non-financial

Performance Indicators

29 Review of Operations

29 Automotive Segment

35 Motorcycles Segment

36 Financial Services Segment

38 Research and Development

41 Purchasing

42 Sales and Marketing

44 Workforce

45 Sustainability

49 Results of Operations, Financial

Position and Net Assets

59 Comments on Financial Statements

of BMW AG

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Financial Reporting Process

83

Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

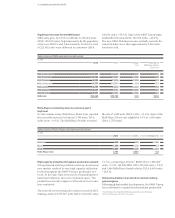

EBIT margin and return on capital employed

The EBIT margin in the Automotive segment (profit

be-

fore financial result divided by revenues) came in at 9.2 %

(2014: 9.6 %; – 0.4 percentage points). As predicted, the

EBIT margin from automobile business was within the

target range of between 8 and 10 % and thus in line with

forecasts.

The return on capital employed (RoCE) amounted to

72.2 % (2014: 61.7 %; + 10.5 percentage points). The

higher-than-expected increase in RoCE reflects the

pleasing upward trend in earnings on the one hand

and

the rigorous management of capital employed on

the other. A number of other factors also influenced

RoCE, including transactions with other segments, the

higher volume of business with service and Connected

Drive contracts as well as efficiency improvements in

investing activities. In the Annual Report 2014, a

moderate decrease in RoCE was predicted. The rate

achieved by the Automotive segment was therefore

well

above the minimum target of 26 %.

Motorcycles segment

Sales volume

In a highly favourable market environment, most notably

in Europe, BMW Motorrad achieved a significant in-

crease of 10.9 % with a sales volume of 136,963 units

(2014: 123,495 units). This performance was therefore

better than the solid increase forecast in the Annual

Report 2014. Apart from the robust market environment

and BMW Motorrad’s attractive model range, mild

weather conditions at the end of the year also gave the

strong performance additional tailwind.

Return on capital employed

The Motorcycles segment generated a return on capital

employed (RoCE) of 31.6 % in the year under report

(2014: 21.8 %; + 9.8 percentage points), a solid increase

on the previous year. In the Quarterly Report at 30 June

2015, the outlook was for a slight increase in RoCE

(outlook in the Annual Report 2014: RoCE in line with

the previous year’s level). Contributing factors for the

improved performance were higher sales volume, a

sus-

tained high-value model mix and the positive impact

of

the new brand strategy embarked upon in 2014.

Financial Services segment

Return on equity

The return on equity (RoE) generated by the Financial

Services segment improved to 20.2 % in the year under

report (2014: 19.4 %; + 0.8 percentage points), helped by

a strong operating performance and a stable risk

pro-

file. As predicted in the Annual Report 2014, RoE was

in line with the previous year’s level and therefore

re-

mained ahead of the minimum target of 18 %.

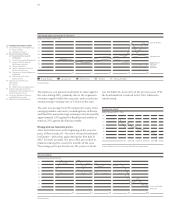

The following overall picture arises for the principal per-

formance indicators utilised by the BMW Group and its

segments:

Comparison of 2015 forecasts with actual outcomes 2015

Forecast for 2015 Forecast revision Actual outcome

in 2014 Annual Report during the year in 2015

BMW Group

Profit before tax solid increase € million 9,224 (+ 5.9 %)

Workforce at year-end solid increase 122,244 (+ 5.1%)

Automotive segment

Sales volume1 solid increase units 2,247,485 (+ 6.1 %)

Fleet emissions2

slight

decrease

g CO2 / km 127 (– 2.3 %)

Revenues solid increase Q1: significant increase € million 85,536 (+ 13.8 %)

EBIT margin target range between 8 and 10 %

% 9.2 (– 0.4 %pts)

Return on capital employed

moderate

decrease

% 72.2 (+ 10.5 %pts)

Motorcycles segment

Sales volume solid increase units 136,963 (+ 10.9 %)

Return on capital employed in line with last year’s level Q2: slight increase % 31.6 (+ 9.8 %pts)

Financial Services segment

Return on equity in line with last year’s level

% 20.2 (+ 0.8 %pts)

1 Including the joint venture BMW Brilliance Automotive Ltd., Shenyang (2015: 282,000 units).

2 EU-28.