Advance Auto Parts 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-41

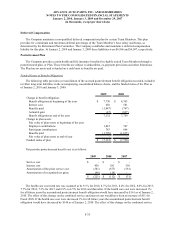

as elected by the participants in accordance with the DSU Plan.

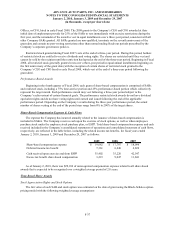

The Company granted 19 DSUs in Fiscal 2009. The weighted average fair value of DSUs granted during Fiscal

2009, 2008, and 2007 was $44.18, $38.94, and $41.64, respectively. The DSUs are awarded at a price equal to the

market price of the Company’s underlying stock on the date of the grant. For Fiscal 2009, 2008, and 2007,

respectively, the Company recognized a total of $850, $480, and $344 on a pre-tax basis, in compensation expense

for these DSU grants.

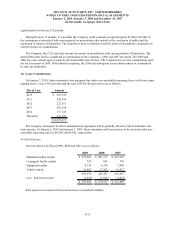

LTIP Availability

At January 2, 2010, there were 2,252 shares of common stock currently available for future issuance under the

2004 Plan. The Company issues new shares of common stock upon exercise of stock options and SARs.

Employee Stock Purchase Plan

The Company also offers an ESPP. Eligible Team Members may purchase the Company’s common stock at

95% of its fair market value on the date of purchase. There are annual limitations on Team Member elections of

either $25 per Team Member or ten percent of compensation, whichever is less. Under the plan, Team Members

acquired 51, 80 and 53 shares in Fiscal 2009, 2008 and 2007, respectively. At January 2, 2010, there were 1,277

shares available to be issued under the plan.

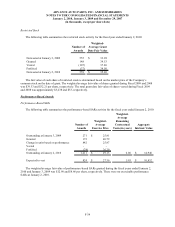

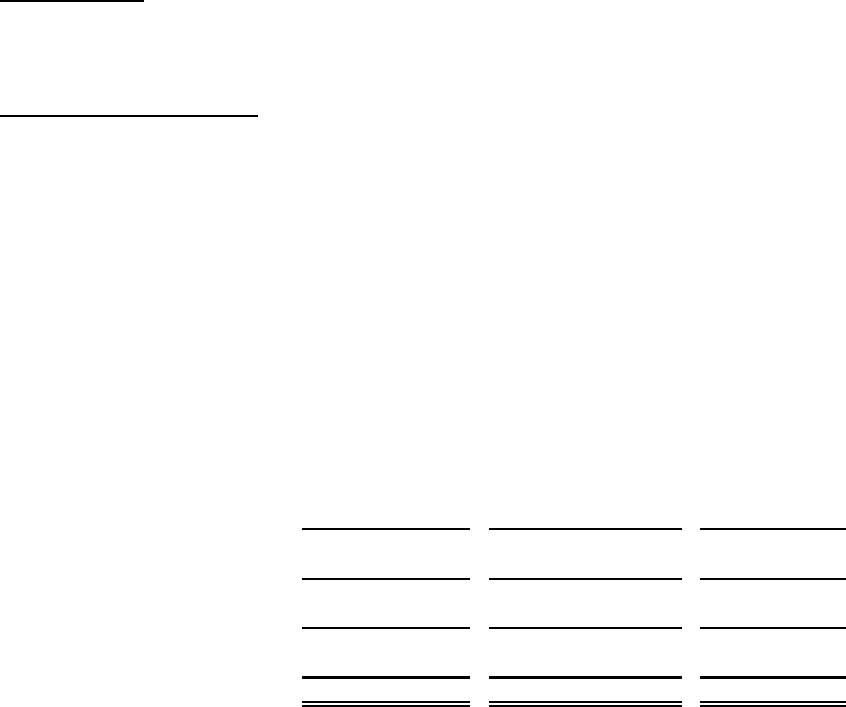

20. Accumulated Other Comprehensive Income (Loss):

Comprehensive income is computed as net earnings plus certain other items that are recorded directly to

shareholders’ equity during the accounting period. In addition to net earnings, comprehensive income also includes

changes in unrealized gains or losses on hedge arrangements and postretirement plan benefits, net of tax.

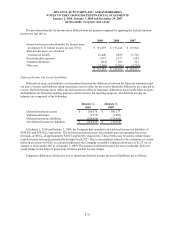

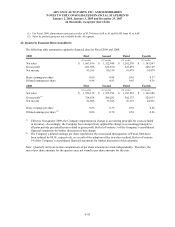

Accumulated other comprehensive income (loss), net of tax, for Fiscal 2007, 2008 and 2009 consisted of the

following:

Accumulated

Unrealized Gain Unrealized Gain (Loss) Other

(Loss) on Hedging on Postretirement Comprehensive

Arrangements Plan Income (Loss)

Balance, December 30, 2006 156$ 3,316$ 3,472$

Fiscal 2007 activity (4,809) 636 (4,173)

Balance, December 29, 2007 (4,653)$ 3,952$ (701)$

Fiscal 2008 activity (8,729) 81 (8,648)

Balance, January 3, 2009 (13,382)$ 4,033$ (9,349)$

Fiscal 2009 activity 3,034 (384) 2,650

Balance, January 2, 2010 (10,348)$ 3,649$ (6,699)$

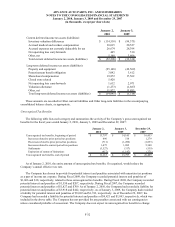

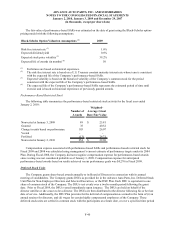

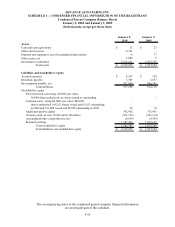

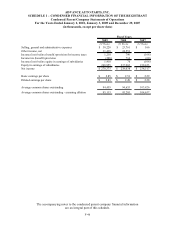

21. Segment and Related Information:

The Company has the following two reportable segments: AAP and AI. The AAP segment is comprised of store

operations within the United States, Puerto Rico and the Virgin Islands which operate 3,264 stores under the trade

names “Advance Auto Parts,” “Advance Discount Auto Parts” and “Western Auto.” These stores offer a broad

selection of brand name and proprietary automotive replacement parts, accessories and maintenance items for

domestic and imported cars and light trucks.

The AI segment consists solely of the operations of Autopart International, which operates as an independent,

wholly-owned subsidiary and operates stores under the “Autopart International” trade name. AI mainly serves the

Commercial market from its 156 store locations primarily throughout the Northeast and Mid-Atlantic regions. In