Advance Auto Parts 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-26

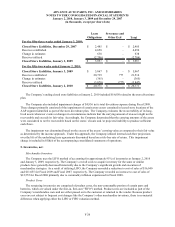

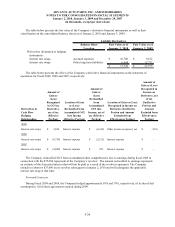

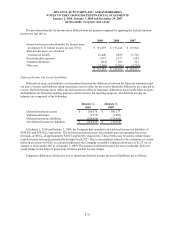

Non-Financial Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring basis; that is, the assets and liabilities

are not measured at fair value on an ongoing basis but are subject to fair value adjustments in certain circumstances

(e.g., when there is evidence of impairment). The Company recorded an impairment charge of $4,936 during Fiscal

2009 to reduce certain store assets in its store divestiture plan to their estimated fair value of zero. The fair values

were determined based on the income approach, in which the Company utilized internal cash flow projections over

the life of the underlying lease agreements discounted based on a risk-free rate of return. These measures of fair

value, and related inputs, are considered a level 3 approach under the fair value hierarchy. There were no other

changes related to level 3 assets.

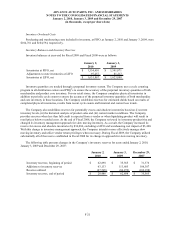

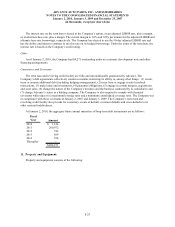

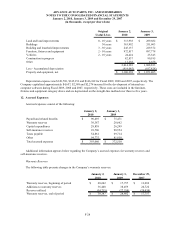

10. Long-term Debt:

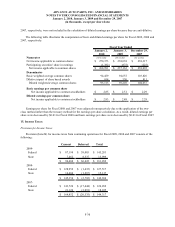

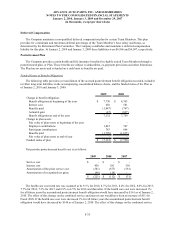

Long-term debt consists of the following:

January 2,

2010

January 3,

2009

Senior Debt:

Revolving credit facility at variable interest rates

(4.81% at January 3, 2009) due October 2011 -$ 251,500$

Term loan at variable interest rates

(1.31% and 3.02% at January 2, 2010 and January 3,

2009, respectively) due October 2011 200,000 200,000

Other 4,271 4,664

204,271 456,164

Less: Current portion of long-term debt (1,344) (1,003)

Long-term debt, excluding current portion 202,927$ 455,161$

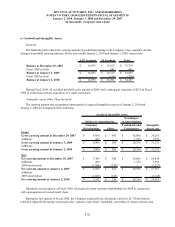

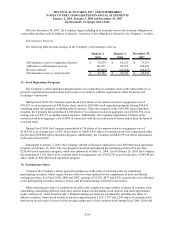

Bank Debt

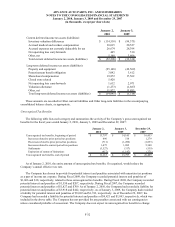

The Company has a $750,000 unsecured five-year revolving credit facility with Stores serving as the borrower.

The revolving credit facility also provides for the issuance of letters of credit with a sub limit of $300,000, and

swingline loans in an amount not to exceed $50,000. The Company may request, subject to agreement by one or

more lenders, that the total revolving commitment be increased by an amount not exceeding $250,000 (up to a total

commitment of $1,000,000) during the term of the credit agreement. Voluntary prepayments and voluntary

reductions of the revolving balance are permitted in whole or in part, at the Company’s option, in minimum principal

amounts as specified in the revolving credit facility. The revolving credit facility matures on October 5, 2011.

As of January 2, 2010, the Company had no amount outstanding under its revolving credit facility, and letters of

credit outstanding of $99,805, which reduced the availability under the revolving credit facility to $650,195. (The

letters of credit generally have a term of one year or less.) A commitment fee is charged on the unused portion of the

revolver, payable in arrears. The current commitment fee rate is 0.150% per annum.

As January 2, 2010, the Company had $200,000 outstanding under its unsecured four-year term loan. The

Company entered into the term loan in Fiscal 2007 with Stores serving as borrower. The term loan matures on

October 5, 2011.

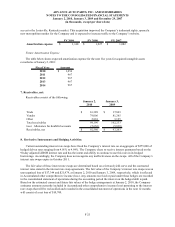

The interest rate on borrowings under the revolving credit facility is based, at the Company’s option, on an

adjusted LIBOR rate, plus a margin, or an alternate base rate, plus a margin. The current margin is 0.75% and 0.0%

per annum for the adjusted LIBOR and alternate base rate borrowings, respectively. The Company has elected to use

the 90-day adjusted LIBOR rate and has the ability and intent to continue to use this rate on its hedged borrowings.

Under the terms of the revolving credit facility, the interest rate and commitment fee are based on the Company’s

credit rating.