Advance Auto Parts 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

• a $23.4 million increase in net income exclusive of a $23.6 million non-cash inventory adjustment (net of

tax) as a result of our favorable operating income during Fiscal 2008 (inclusive of the approximate $9.6

million impact of the 53rd week); and

• a $29.5 million increase in cash flows resulting from the timing of the payment of accrued operating

expenses.

Investing Activities

For Fiscal 2009, net cash used in investing activities increased by $3.9 million to $185.5 million. The increase

in cash used was primarily due to an increase in routine spending on our existing stores and information technology

investments, partially offset by fewer stores opened and the timing of store development expenditures.

For Fiscal 2008, net cash used in investing activities decreased by $20.5 million to $181.6 million. The

decrease in cash used was primarily due to:

• a $25.6 million decrease in capital expenditures reflective of a reduction in store development; and

• the absence of $6.6 million in insurance proceeds received in Fiscal 2007.

Financing Activities

For Fiscal 2009, net cash used in financing activities increased by $177.1 million to $451.5 million. Cash flows

from financing activities increased as a result of a decrease of $119.4 million in repurchases of common stock under

our stock repurchase program. Cash flows from financing activities decreased as result of:

• a $202.0 million increase in net debt repayments, primarily under our revolving credit facility; and

• a $87.1 million decrease in financed vendor accounts payable driven by the transition of our vendors from

our vendor financing program to our vendor program.

For Fiscal 2008, net cash used in financing activities increased by $69.6 million to $274.4 million. Cash flows

from financing activities increased as a result of a $63.5 million decrease in the repurchase of common stock under

our stock repurchase program. Cash flows from financing activities decreased as result of:

• a $5.2 million cash outflow resulting from the timing of bank overdrafts;

• a $43.2 million decrease in financed vendor accounts payable driven by the transition of our vendors from

our vendor financing program to our vendor program;

• a reduction of $78.6 million in net borrowings primarily under our credit facilities; and

• a $7.3 million decrease in additional tax benefits associated with the decreased number of stock options

exercised.

Off-Balance-Sheet Arrangements

As of January 2, 2010, we had no off-balance-sheet arrangements as defined in Regulation S-K Item 303 of the

SEC regulations. We include other off-balance-sheet arrangements in our contractual obligations table including

operating lease payments, interest payments on our credit facility and letters of credit outstanding.

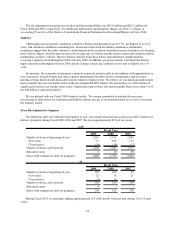

Contractual Obligations

In addition to our revolving credit facility, we utilize operating leases as another source of financing. The

amounts payable under these operating leases are included in our schedule of contractual obligations. Our future

contractual obligations related to long-term debt, operating leases and other contractual obligations at January 2,

2010 were as follows: