Advance Auto Parts 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-27

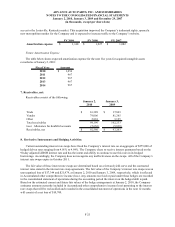

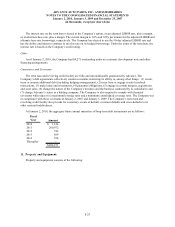

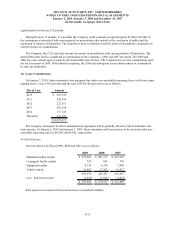

The interest rate on the term loan is based, at the Company’s option, on an adjusted LIBOR rate, plus a margin,

or an alternate base rate, plus a margin. The current margin is 1.0% and 0.0% per annum for the adjusted LIBOR and

alternate base rate borrowings, respectively. The Company has elected to use the 90-day adjusted LIBOR rate and

has the ability and intent to continue to use this rate on its hedged borrowings. Under the terms of the term loan, the

interest rate is based on the Company’s credit rating.

Other

As of January 2, 2010, the Company had $4,271 outstanding under an economic development note and other

financing arrangements.

Guarantees and Covenants

The term loan and revolving credit facility are fully and unconditionally guaranteed by Advance. The

Company’s debt agreements collectively contain covenants restricting its ability to, among other things: (1) create,

incur or assume additional debt (including hedging arrangements), (2) incur liens or engage in sale-leaseback

transactions, (3) make loans and investments, (4) guarantee obligations, (5) engage in certain mergers, acquisitions

and asset sales, (6) change the nature of the Company’s business and the business conducted by its subsidiaries and

(7) change Advance’s status as a holding company. The Company is also required to comply with financial

covenants with respect to a maximum leverage ratio and a minimum consolidated coverage ratio. The Company was

in compliance with these covenants at January 2, 2010 and January 3, 2009. The Company’s term loan and

revolving credit facility also provide for customary events of default, covenant defaults and cross-defaults to its

other material indebtedness.

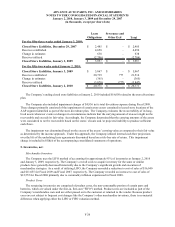

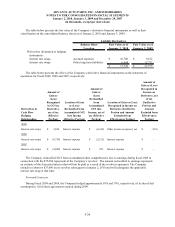

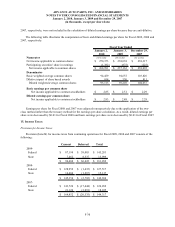

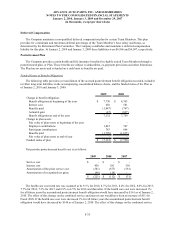

At January 2, 2010, the aggregate future annual maturities of long-term debt instruments are as follows:

Fiscal

Year Amount

2010 1,344$

2011 200,972

2012 742

2013 689

2014 524

Thereafter -

204,271$

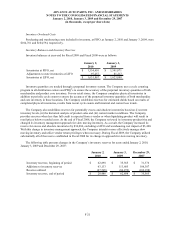

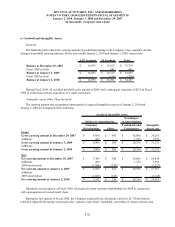

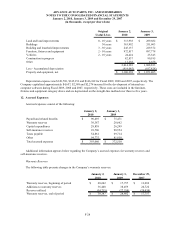

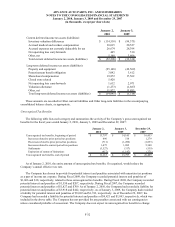

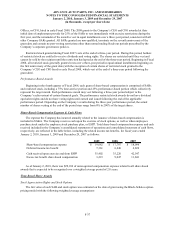

11. Property and Equipment:

Property and equipment consists of the following: