Advance Auto Parts 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-40

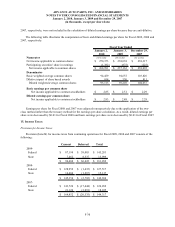

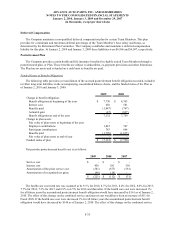

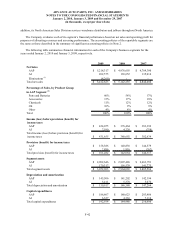

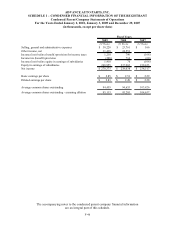

The fair value of performance-based SARs was estimated on the date of grant using the Black-Scholes option-

pricing model with the following assumptions:

Black-Scholes Option Valuation Assumptions

(1)

2009

Risk-free interest rate

(2)

1.6%

Expected dividend yield 0.6%

Expected stock price volatility

(3)

39.2%

Expected life of awards (in months)

(4)

50

(1) Forfeitures are based on historical experience.

(2) The risk-free interest rate is based on a U.S. Treasury constant maturity interest rate whose term is consistent

with the expected life of the Company’s performance-based SARs.

(3) Expected volatility is based on the historical volatility of the Company’s common stock for the period

consistent with the expected life of the Company’s performance-based SARs.

(4) The expected life of the Company’s performance-based SARs represents the estimated period of time until

exercise and is based on historical experience of previously granted awards.

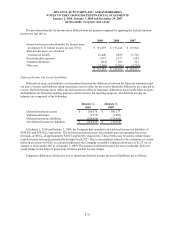

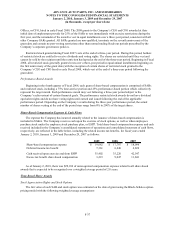

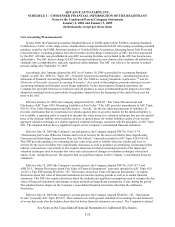

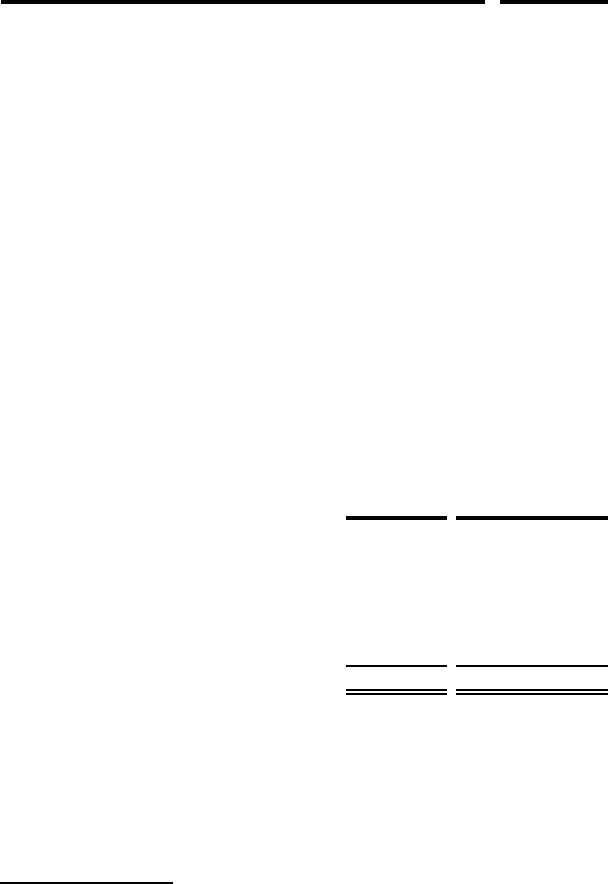

Performance-Based Restricted Stock

The following table summarizes the performance-based restricted stock activity for the fiscal year ended

January 2, 2010:

Number of

Awards

Weighted-

Average Grant

Date Fair Value

Nonvested at January 3, 2009 49 25.81$

Granted 35 40.52

Change in units based on performance 183 26.07

Vested - -

Forfeited (13) 26.71

Nonvested at January 2, 2010 254 29.08$

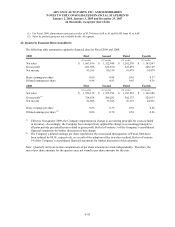

Compensation expense associated with performance-based SARs and performance-based restricted stock for

Fiscal 2009 and 2008 was calculated using management’s current estimate of performance targets under its 2004

Plan. During Fiscal 2008, the Company did not recognize compensation expense for performance-based awards

since vesting was not considered probable as of January 3, 2009. Compensation expense for anticipated

performance-based awards based on results achieved versus performance goals was $4,276 in Fiscal 2009.

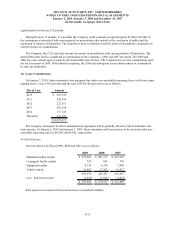

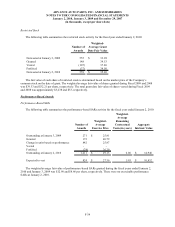

Deferred Stock Units

The Company grants share-based awards annually to its Board of Directors in connection with its annual

meeting of stockholders. The Company grants DSUs as provided for in the Advance Auto Parts, Inc. Deferred Stock

Unit Plan for Non-Employee Directors and Selected Executives, or the DSU Plan. Each DSU is equivalent to one

share of common stock of the Company. The DSUs vest evenly over a twelve-month period following the grant

date. Prior to Fiscal 2009, the DSUs vested immediately upon issuance. The DSUs are held on behalf of the

director until he or she ceases to be a director. The DSUs are then distributed to the director following his or her last

date of service. Additionally, the DSU Plan provides for the deferral of compensation as earned in the form of (i) an

annual retainer for directors, and (ii) wages for certain highly compensated employees of the Company. These

deferred stock units are settled in common stock with the participants at a future date, or over a specified time period