Advance Auto Parts 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-21

Inventory Overhead Costs

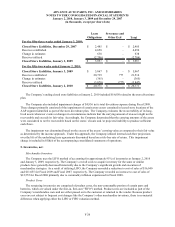

Purchasing and warehousing costs included in inventory, at FIFO, at January 2, 2010 and January 3, 2009, were

$104,761 and $104,594, respectively.

Inventory Balances and Inventory Reserves

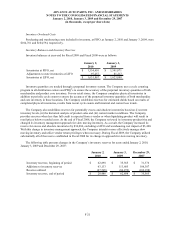

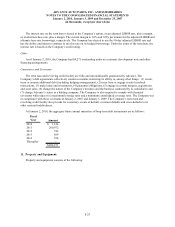

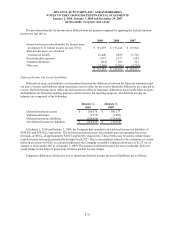

Inventory balances at year-end for Fiscal 2009 and Fiscal 2008 were as follows:

January 2, January 3,

2010 2009

Inventories at FIFO, net 1,534,610$ 1,541,871$

Adjustments to state inventories at LIFO 97,257 81,217

Inventories at LIFO, net 1,631,867$ 1,623,088$

Inventory quantities are tracked through a perpetual inventory system. The Company uses a cycle counting

program in all distribution centers and PDQ®s to ensure the accuracy of the perpetual inventory quantities of both

merchandise and product core inventory. For our retail stores, the Company completes physical inventories in

addition to periodic cycle counts to ensure the accuracy of the perpetual inventory quantities of both merchandise

and core inventory in these locations. The Company establishes reserves for estimated shrink based on results of

completed physical inventories, results from recent cycle counts and historical and current loss trends.

The Company also establishes reserves for potentially excess and obsolete inventories based on (i) current

inventory levels, (ii) the historical analysis of product sales and (iii) current market conditions. The Company

provides reserves when less than full credit is expected from a vendor or when liquidating product will result in

retail prices below recorded costs. At the end of Fiscal 2008, the Company reviewed its inventory productivity and

changed its inventory management approach for slow moving inventory. As a result, the Company increased its

reserve for excess and obsolete inventories by $34,084, excluding a LIFO and warehousing cost impact of $3,400.

With this change in inventory management approach, the Company intends to more effectively manage slow

moving inventory and utilize vendor return privileges when necessary. During Fiscal 2009, the Company utilized

substantially all of the reserve established in Fiscal 2008 for its change in approach for slow moving inventory.

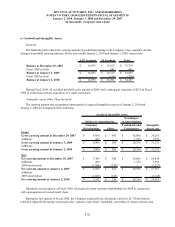

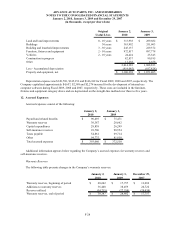

The following table presents changes in the Company’s inventory reserves for years ended January 2, 2010,

January 3, 2009 and December 29, 2007:

January 2, January 3, December 29,

2010 2009 2007

Inventory reserves, beginning of period 62,898$ 35,565$ 31,376$

Additions to inventory reserves 63,133 113,605 106,387

Reserves utilized (97,545) (86,272) (102,198)

Inventory reserves, end of period 28,486$ 62,898$ 35,565$