Advance Auto Parts 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-23

access to the Louisville, Kentucky market. This acquisition improved the Company’s trademark rights, opened a

new metropolitan market for the Company and is expected to increase traffic to the Company’s website.

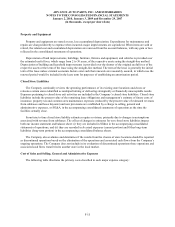

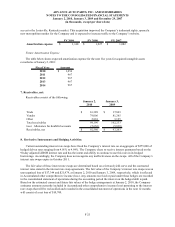

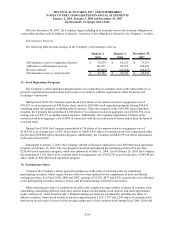

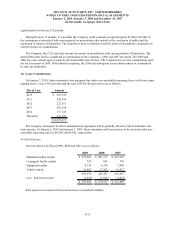

FY 2009 FY 2008 FY 2007

Amortization expense 1,148$ 1,227$ 1,082$

Future Amortization Expense

The table below shows expected amortization expense for the next five years for acquired intangible assets

recorded as of January 2, 2010:

Fiscal Year Amount

2010 1,054$

2011 967

2012 967

2013 967

2014 967

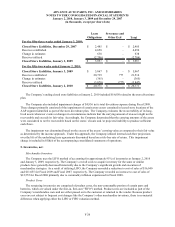

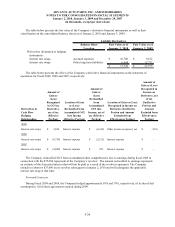

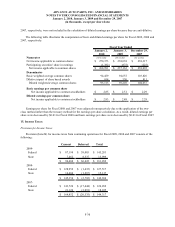

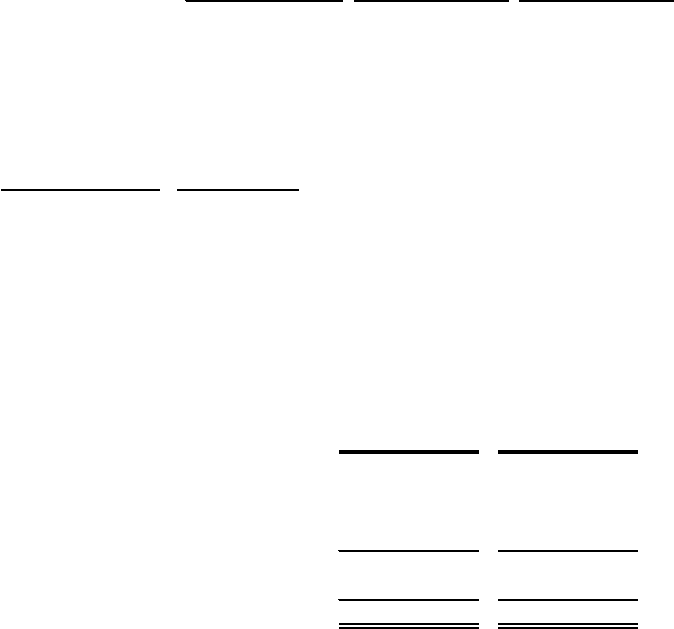

7. Receivables, net:

Receivables consist of the following:

January 2, January 3,

2010 2009

Trade 16,389$ 17,843$

Vendor 79,006 81,265

Other 2,801 3,125

Total receivables 98,196 102,233

Less: Allowance for doubtful accounts (5,636) (5,030)

Receivables, ne

t

92,560$ 97,203$

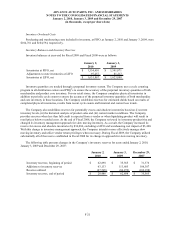

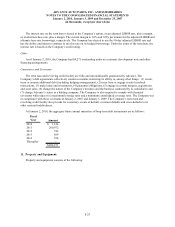

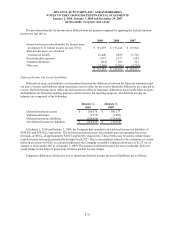

8. Derivative Instruments and Hedging Activities:

Current outstanding interest rate swaps have fixed the Company’s interest rate on an aggregate of $275,000 of

hedged debt at rates ranging from 4.01% to 4.98%. The Company elects to receive interest payments based on the

90-day adjusted LIBOR interest rate and has the intent and ability to continue to use this rate on its hedged

borrowings. Accordingly, the Company does not recognize any ineffectiveness on the swaps. All of the Company’s

interest rate swaps expire in October 2011.

The fair value of these interest rate swaps are determined based on a forward yield curve and the contracted

interest rates stated in the interest rate swap agreements. The fair value of the Company’s interest rate swaps was an

unrecognized loss of $17,344 and $21,979, at January 2, 2010 and January 3, 2009, respectively, which is reflected

in Accumulated other comprehensive income (loss). Any amounts received or paid under these hedges are recorded

in the consolidated statement of operations during the accounting period the interest on the hedged debt is paid.

Based on the estimated current and future fair values of the hedge arrangements at January 2, 2010, the Company

estimates amounts currently included in Accumulated other comprehensive income (loss) pertaining to the interest

rate swaps that will be reclassified and recorded in the consolidated statement of operations in the next 12 months

will consist of a net loss of $10,700.