Advance Auto Parts 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-29

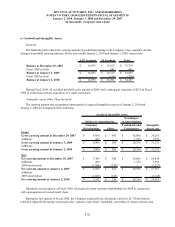

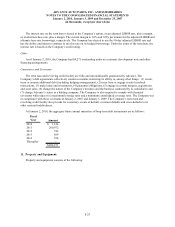

Effective December 30, 2007, the Company began including in its warranty reserve the warranty obligation on

certain other products sold in addition to batteries. A portion of this obligation is funded by the Company’s vendors.

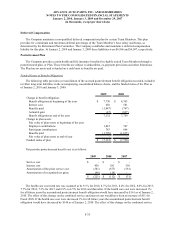

Self-insurance Reserves

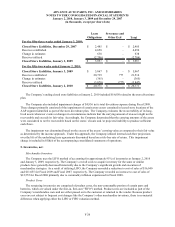

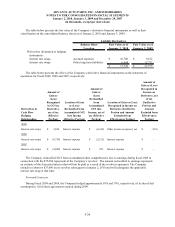

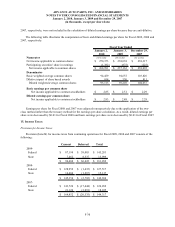

The following table presents changes in the Company’s self-insurance reserves:

January 2, January 3, December 29,

2010 2009 2007

Self-insurance reserves, beginning of period 90,554$ 85,523$ 71,519$

Additions to self-insurance reserves 102,571 89,315 102,641

Reserves utilized (99,419) (84,284) (88,637)

Self-insurance reserves, end of period 93,706$ 90,554$ 85,523$

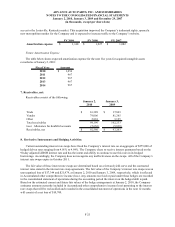

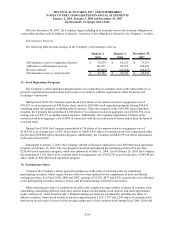

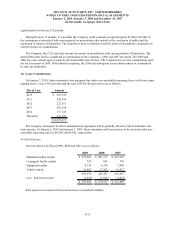

13. Stock Repurchase Program:

The Company’s stock repurchase program allows it to repurchase its common stock on the open market or in

privately negotiated transactions from time to time in accordance with the requirements of the Securities and

Exchange Commission.

During Fiscal 2009, the Company repurchased 2,467 shares of its common stock at an aggregate cost of

$99,567, or an average price of $40.36 per share, under its $250,000 stock repurchase program leaving $89,406

remaining under this program, excluding related expenses. Since the inception of the $250,000 stock repurchase

program, the Company has repurchased 4,040 shares of its common stock at an aggregate cost of $160,594, or an

average price of $39.75, excluding related expenses. Additionally, the Company repurchased 12 shares of its

common stock at an aggregate cost of $495 in connection with the net settlement of shares issued from the lapse of

restricted stock.

During Fiscal 2008, the Company repurchased 6,136 shares of its common stock at an aggregate cost of

$216,470, or an average price of $35.28 per share, of which 4,563 shares of common stock were repurchased under

the previous $500,000 stock repurchase program. Additionally, the Company settled $2,959 on shares repurchased

at the end of Fiscal 2007.

Subsequent to January 2, 2010, the Company’s Board of Directors authorized a new $500,000 stock repurchase

program on February 16, 2010. The new program cancelled and replaced the remaining portion of its previous

$250,000 stock repurchase program, which was authorized on May 15, 2008. As of February 26, 2010, the Company

has repurchased 1,392 shares of its common stock at an aggregate cost of $56,236, or an average price of $40.40 per

share, under its $500,000 stock repurchase program.

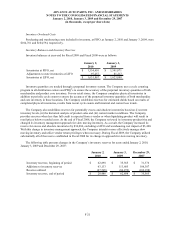

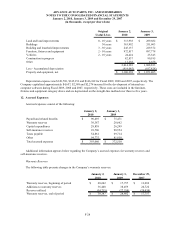

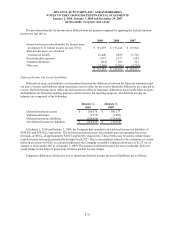

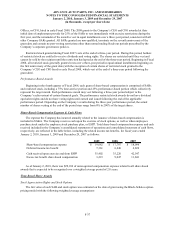

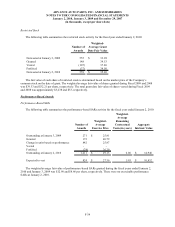

14. Earnings per Share:

Certain of the Company’s shares granted to employees in the form of restricted stock are considered

participating securities, which require the use of the two-class method for the computation of basic and diluted

earnings per share. For Fiscal 2009, 2008 and 2007, earnings of $1,382, $875 and $225, respectively, were allocated

to the participating securities exclusive of any cash dividends already reflected in net income.

Diluted earnings per share of common stock reflects the weighted-average number of shares of common stock

outstanding, outstanding deferred stock units and the impact of outstanding stock options, and stock appreciation

rights (collectively “share-based awards”). Diluted earnings per share are calculated by including the effect of

dilutive securities. Share-based awards to purchase approximately 1,224, 2,747 and 2,549 shares of common stock

that had an exercise price in excess of the average market price of the common stock during Fiscal 2009, 2008 and