Advance Auto Parts 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-24

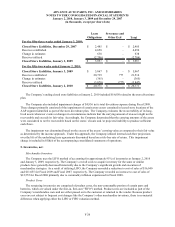

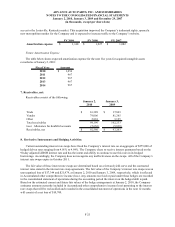

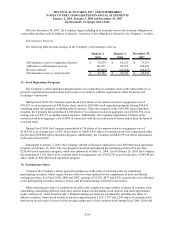

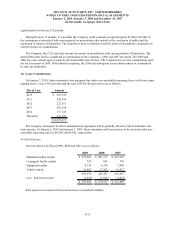

The table below presents the fair value of the Company’s derivative financial instruments as well as their

classification on the consolidated balance sheets as of January 2, 2010 and January 3, 2009:

Balance Sheet Fair Value as of Fair Value as of

Location January 2, 2010 January 3, 2009

Derivatives designated as hedging

instruments:

Interest rate swaps Accrued expenses 10,700$ 9,222$

Interest rate swaps Other long-term liabilities 6,644 12,757

17,344$ 21,979$

Liability Derivatives

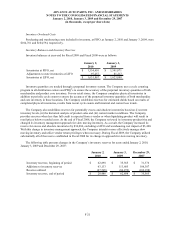

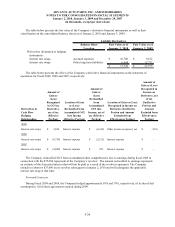

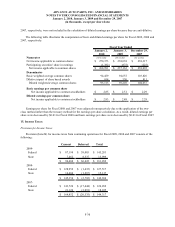

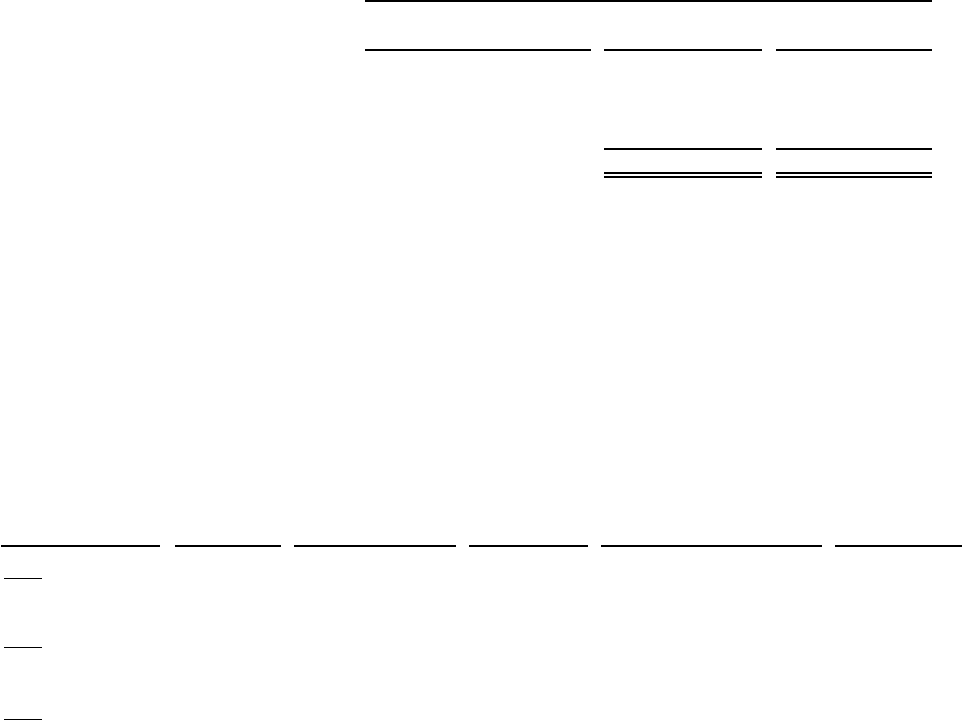

The table below presents the effect of the Company’s derivative financial instruments on the statement of

operations for Fiscal 2009, 2008 and 2007, respectively:

Derivatives in

Cash Flow

Hedging

Relationships

Amount of

Gain or

(Loss)

Recognized

in OCI on

Derivative,

net of tax

(Effective

Portion)

Location of Gain

or (Loss)

Reclassified from

Accumulated OCI

into Income

(Effective Portion)

Amount of

Gain or

(Loss)

Reclassified

from

Accumulated

OCI into

Income, net of

tax (Effective

Portion)

Location of Gain or (Loss)

Recognized in Income on

Derivative (Ineffective

Portion and Amount

Excluded from

Effectiveness Testing)

A

mount o

f

Gain or (Loss)

Recognized in

Income on

Derivative, net

of tax

(Ineffective

Portion and

Amount

Excluded from

Effectiveness

Testing)

2009

Interest rate swaps 3,034$ Interest expense (6,618)$ Other income (expense), net (130)$

2008

Interest rate swaps (8,729)$ Interest expense (2,152)$ Interest expense -$

2007

Interest rate swaps (4,809)$ Interest expense 523$ Interest expense -$

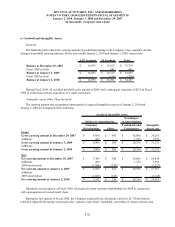

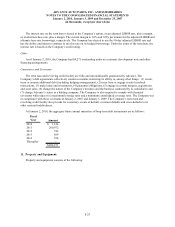

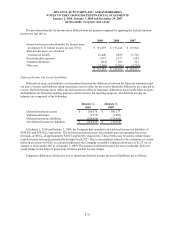

The Company reclassified $213 from accumulated other comprehensive loss to earnings during fiscal 2009 in

connection with the $75,000 repayment of the Company’s revolver. The amount reclassified to earnings represents

an estimate of the forecasted interest that will not be paid as a result of the revolver repayment. The Company

intends to reborrow $75,000 on its revolver subsequent to January 2, 2010 and will redesignate the applicable

interest rate swap at that time.

Forward Contracts

During Fiscal 2009 and 2008, the Company hedged approximately 50% and 70%, respectively, of its diesel fuel

consumption. All of these agreements expired during 2009.