Advance Auto Parts 2009 Annual Report Download - page 66

Download and view the complete annual report

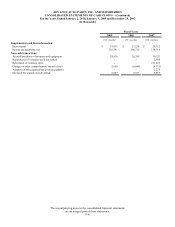

Please find page 66 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-13

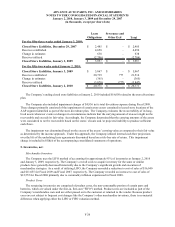

The Company’s Accumulated other comprehensive loss is comprised of the effective portion of fair value

adjustments of interest rate swap transactions and the net unrealized gain associated with the Company’s

postretirement benefit plan.

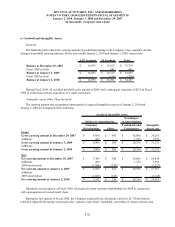

Goodwill and Other Intangible Assets

Goodwill is the excess of the purchase price over the fair value of identifiable net assets acquired in business

combinations accounted for under the purchase method. The Company tests goodwill and indefinite-lived intangible

assets for impairment annually as of the first day of the fiscal fourth quarter, or when indications of potential

impairment exist. These indicators would include a significant change in operating performance, the business

climate, legal factors, competition, or a planned sale or disposition of a significant portion of the business, among

other factors.

Testing for impairment is a two-step process. The first step is a review for potential impairment, while the

second step measures the amount of impairment, if any. Under the first step, the Company compares the fair value

of its reporting units with their respective carrying amounts, including goodwill. If the fair value of a reporting unit

exceeds its carrying amount, goodwill of the reporting unit is considered not impaired and the second step of the

impairment test is unnecessary. If the carrying amount of the reporting unit exceeds its fair value, the second step of

the impairment test must be performed to measure the amount of impairment loss to be recognized, if any. An

impairment loss is recognized when the fair value of goodwill or other intangible asset is below its carrying value.

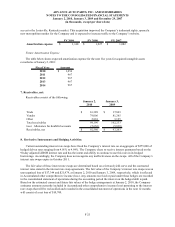

Valuation of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets whenever events or changes in circumstances

indicate that the carrying amount of an asset might not be recoverable and exceeds its fair value.

Significant factors, which would trigger an impairment review, include the following:

• Significant decrease in the market price of a long-lived asset (asset group);

• Significant changes in how assets are used or are planned to be used;

• Significant adverse change in legal factors or business climate, including adverse regulatory action;

• Significant negative industry trends;

• An accumulation of costs significantly in excess of the amount originally expected for the acquisition or

construction of a long-lived asset (asset group);

• Significant changes in technology;

• A current-period operating or cash flow loss combined with a history of operating or cash flow losses, or a

projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset

(asset group); or

• A current expectation that, more likely than not, a long-lived asset (asset group) will be sold or otherwise

disposed of significantly before the end of its previously estimated useful life.

When such an event occurs, the Company estimates the undiscounted future cash flows expected to result from

the use of the long-lived asset (asset group) and its eventual disposition. These impairment evaluations involve

estimates of asset useful lives and future cash flows. If the undiscounted expected future cash flows are less than the

carrying amount of the asset and the carrying amount of the asset exceeds its fair value, an impairment loss is

recognized. Management utilizes an expected present value technique, which uses a risk-free interest rate and

multiple cash flow scenarios reflecting a range of possible outcomes, to estimate the fair value of its long-lived

assets. Actual useful lives and cash flows could differ from those estimated by management using these techniques,

which could have a material effect on our results of operations, financial position or cash flows.