Advance Auto Parts 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Introduction

We are a leading specialty retailer of automotive aftermarket parts, accessories, batteries and maintenance items

primarily operating within the United States. Our stores carry an extensive product line for cars, vans, sport utility

vehicles and light trucks. We serve both DIY and Commercial customers. At January 2, 2010, we operated 3,420

stores throughout 39 states, Puerto Rico and the Virgin Islands.

We operate in two reportable segments: Advance Auto Parts, or AAP, and Autopart International, or AI. The

AAP segment is comprised of our store operations within the United States, Puerto Rico and the Virgin Islands

which operate under the trade names “Advance Auto Parts,” “Advance Discount Auto Parts” and “Western Auto.”

At January 2, 2010, we operated 3,264 stores in the AAP segment, of which 3,238 stores operated under the trade

names “Advance Auto Parts” and “Advance Discount Auto Parts” throughout 39 states in the Northeastern,

Southeastern and Midwestern regions of the United States. These stores offer automotive replacement parts,

accessories and maintenance items. In addition, we operated 26 stores under the “Western Auto” and “Advance

Auto Parts” trade names, located in Puerto Rico and the Virgin Islands, or Offshore.

At January 2, 2010, we operated 156 stores in the AI segment under the “Autopart International” trade name.

We acquired AI in September 2005. AI operates as an independent, wholly-owned subsidiary. AI’s business

primarily serves the Commercial market from its store locations located primarily in the Northeast and Mid-Atlantic

regions. In addition, its North American Sales Division services warehouse distributors and jobbers throughout

North America.

Management Overview

During Fiscal 2009, we produced favorable financial results primarily due to top-line sales growth and strong

gross profit improvement resulting in earnings per diluted share, or EPS, of $2.83 compared to $2.49 in Fiscal 2008.

Although we have presented our financial results in this Form 10-K in conformity with accounting principles

generally accepted in the United States (GAAP), our financial results for Fiscal 2009 and Fiscal 2008 include the

impact of the following significant items. Our Fiscal 2009 results were reduced by an EPS impact of $0.17 resulting

from the closure of 45 stores in connection with our store divestiture plan. Our Fiscal 2008 financial results included

an extra week of operations (53rd week) as well as a non-cash obsolete inventory write-down of $37.5 million due to

a change in inventory management approach for slow moving inventory, or non-cash inventory adjustment. The

impact of the Fiscal 2008 items was a net reduction in EPS of $0.15. We generated significant operating cash flow

in Fiscal 2009 that allowed us to invest in business initiatives related to our four key strategies, repay a significant

portion of our bank debt and repurchase shares of our common stock.

Fiscal 2009 Highlights

Highlights from our Fiscal 2009 include:

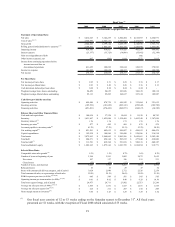

Financial

• Total sales for Fiscal 2009 increased 5.3% over Fiscal 2008 to $5.41 billion. Excluding the impact of the

53rd week in Fiscal 2008, our total sales increased 7.1%. This growth was primarily due to a comparable

store sales increase of 5.3% and sales from the net addition of 52 total stores opened within the last year.

• Our gross profit rate increased 220 basis points as compared to Fiscal 2008. Approximately 73 basis points

of this increase is related to the non-cash inventory adjustment of $37.5 million in Fiscal 2008.

• Our selling, general and administrative expenses, or SG&A, rate increased 187 basis points as compared to

Fiscal 2008 partially due to 48 basis points of store divestiture expenses. Excluding store divestitures, this

increase in SG&A is primarily linked to the targeted investments we are making to support each of our four

key strategies which have already begun to yield benefits in our sales and gross profit results.

• We generated operating cash flow of $699.7 million for the year, an increase of $221.0 million over Fiscal

2008, and used available operating cash to pay down $252.2 million of outstanding bank debt and