Advance Auto Parts 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Dividend

Our Board of Directors have paid quarterly dividends of $0.06 per share to stockholders of record since fiscal

2006. Subsequent to January 2, 2010, our Board of Directors declared a quarterly dividend of $0.06 per share to be

paid on April 9, 2010 to all common stockholders of record as of March 26, 2010.

Other Liquidity

During the last two years, we have transitioned certain of our merchandise vendors from a vendor financing

program to a customer-managed services arrangement, or vendor program. Under this vendor program, a third party

provides an accounts payable tracking system which facilitates the participating suppliers’ ability to finance our

payment obligations with designated third-party financial institutions. Participating suppliers may, at their sole

discretion, make offers to participating financial institutions to finance one or more of our payment obligations prior

to their scheduled due dates at a discounted price. Our obligations to suppliers, including amounts due and scheduled

payment dates, are not impacted by suppliers’ decisions to finance our accounts payable due to them under this

arrangement. Our goal in entering into this arrangement is to capture overall supply chain savings in the form of

pricing, payment terms or vendor funding, created by facilitating our suppliers’ ability to finance payment

obligations at more favorable discount rates, while providing them with greater working capital flexibility.

Any deterioration in the credit markets could adversely impact our ability to secure funding for any of these

programs, which would reduce our anticipated savings, including but not limited to, causing us to increase our

borrowings under our revolving credit facility.

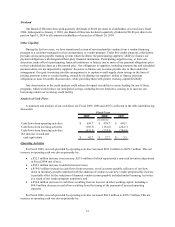

Analysis of Cash Flows

A summary and analysis of our cash flows for Fiscal 2009, 2008 and 2007 is reflected in the table and following

discussion.

2009 2008 2007

Cash flows from operating activities 699.7$ 478.7$ 410.5$

Cash flows from investing activities (185.5) (181.6) (202.1)

Cash flows from financing activities (451.5) (274.4) (204.9)

Net increase in cash and

cash equivalents 62.7$ 22.7$ 3.5$

Fiscal Year

(in millions)

Operating Activities

For Fiscal 2009, net cash provided by operating activities increased $221.0 million to $699.7 million. This net

increase in operating cash was driven primarily by:

• a $32.3 million increase in net income, $23.6 million of which represented a non-cash inventory adjustment

in Fiscal 2008 (net of tax);

• a $69.3 million increase in deferred income taxes;

• a $194.5 million increase in cash flows from inventory, net of accounts payable, reflective of our slow

down in inventory growth combined with the addition of vendors to our new vendor program (this increase

is partially offset by the reduction of financed vendor account payable included under Financing Activities

as a result of our vendor program transition); and

• a $56.6 million decrease in cash flows resulting from an increase in other working capital, including a

$64.0 million decrease in cash flows resulting from the timing of the payment of accrued operating

expenses.

For Fiscal 2008, net cash provided by operating activities increased $68.2 million to $478.7 million. This net

increase in operating cash was driven primarily by: