Advance Auto Parts 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

The net adjustment increasing cost of sales and decreasing SG&A was $63.9 million and $62.3 million for

Fiscal 2008 and 2007, respectively. For additional information regarding this change, see Note 3, Change in

Accounting Principle, of the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K.

Industry

Challenging macroeconomic conditions continue with the unemployment rate at 9.7%, the highest in over 25

years, and consumer confidence remaining low. Financial results from the leading automotive aftermarket

companies suggest that the entire industry is benefiting from the economic downturn because consumers are keeping

their vehicles longer, which in turn increases the average age of vehicles and the need to repair and complete routine

maintenance on those vehicles. Recent statistics indicate miles driven have increased three straight quarters

reversing a negative trend throughout 2008 and early 2009. In addition, gas prices remain well under the historic

highs experienced throughout most of 2008 and the average vehicle age continues to rise and is slightly over 10

years.

In summary, the economic environment continues to present mixed results to our industry with opportunities to

serve customers in need of parts and other required maintenance but other elective maintenance and accessory

purchases being deferred until disposable income returns to higher levels. We believe we can maintain market share

and eventually increase our market share in the less fragmented DIY market. We also believe we will continue to

significantly increase our market share in the Commercial market where our current market share is less than 5% of

the $40 billion Commercial market.

We are pleased with our Fiscal 2009 financial results. We remain committed to making the necessary

investments to help ensure our long-term profitability and the success of our transformation as we strive to become

the industry leader.

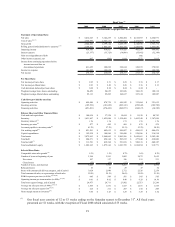

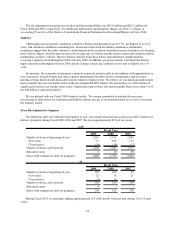

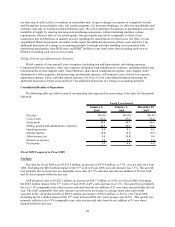

Store Development by Segment

The following table sets forth the total number of new, closed and relocated stores and stores with Commercial

delivery programs during Fiscal 2009, 2008 and 2007. We lease approximately 81% of our stores.

2009 2008 2007

Number of stores at beginning of year 3,243 3,153 2,995

New stores 75 109 175

Closed stores (54) (19) (17)

Number of stores, end of period 3,264 3,243 3,153

Relocated stores 6 10 29

Stores with commercial delivery programs 2,868 2,755 2,604

2009 2008 2007

Number of stores at beginning of year 125 108 87

New stores 32 18 21

Closed stores (1) (1) -

Number of stores, end of period 156 125 108

Relocated stores 4 - -

Stores with commercial delivery programs 156 125 108

AAP

Fiscal Year

AI

Fiscal Year

During Fiscal 2010, we anticipate adding approximately 110 AAP and 40 AI stores and closing 10 to 15 total

stores.