Advance Auto Parts 2009 Annual Report Download - page 102

Download and view the complete annual report

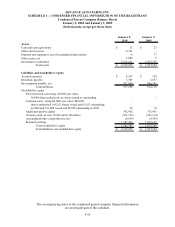

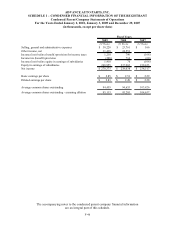

Please find page 102 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC.

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to the Condensed Parent Company Statements

January 2, 2010 and January 3, 2009

(in thousands, except per share data)

See Notes to the Consolidated Financial Statements for Additional Disclosures.

F-49

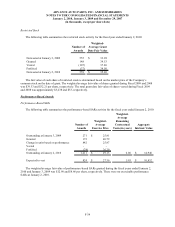

Accumulated Other Comprehensive Income (Loss)

The purpose of reporting Accumulated comprehensive income (loss) is to report a measure of all changes in

equity of an enterprise that result from transactions and other economic events of the period. The changes in

accumulated comprehensive income are reported as other comprehensive income and refer to revenues, expenses,

gains, and losses that are included in other comprehensive income but excluded from net income.

The Company’s Accumulated other comprehensive loss is comprised of the effective portion of fair value

adjustments of interest rate swap transactions and the net unrealized gain associated with the Company’s

postretirement benefit plan.

Earnings per Share

The Company adopted FASB Staff Position, or FSP, EITF 03-6-1, “Determining Whether Instruments Granted

in Share-Based Payment Transactions Are Participating Securities,” effective January 4, 2009 (now included in

overall earnings per share guidance under ASC Topic 260). FSP EITF 03-6-1 addresses whether instruments granted

in share-based payment awards are participating securities prior to vesting, and therefore, need to be included in the

earnings allocation when computing earnings per share under the two-class method. Unvested share-based payment

awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

participating securities and shall be included in the computation of earnings per share pursuant to the two-class

method. Certain of the Company’s shares granted to employees in the form of restricted stock are considered

participating securities which require the use of the two-class method for the computation of basic and diluted

earnings per share.

Accordingly, earnings per share is determined using the two-class method and is computed by dividing net

income attributable to the Company’s common shareholders by the weighted-average common shares outstanding

during the period. The two-class method is an earnings allocation formula that determines income per share for each

class of common stock and participating security according to dividends declared and participation rights in

undistributed earnings. Diluted income per common share reflects the more dilutive earnings per share amount

calculated using the treasury stock method or the two-class method.

Basic earnings per share of common stock has been computed based on the weighted-average number of

common shares outstanding during the period, which is reduced by stock held in treasury and shares of nonvested

restricted stock. Diluted earnings per share of common stock reflects the weighted-average number of shares of

common stock outstanding, outstanding deferred stock units and the impact of outstanding stock options, and stock

appreciation rights (collectively “share-based awards”). Diluted earnings per share are calculated by including the

effect of dilutive securities.

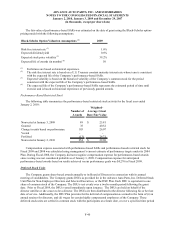

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and

repairs are charged directly to expense when incurred; major improvements are capitalized. When items are sold or

retired, the related cost and accumulated depreciation are removed from the account balances, with any gain or loss

reflected in the consolidated statements of operations.

Depreciation of land improvements, buildings, furniture, fixtures and equipment, and vehicles is provided over

the estimated useful lives, which range from 2 to 30 years, of the respective assets using the straight-line method.

Depreciation of building and leasehold improvements is provided over the shorter of the original useful lives of the

respective assets or the term of the lease using the straight-line method. The term of the lease is generally the initial

term of the lease unless external economic factors exist such that renewals are reasonably assured, in which case the

renewal period would be included in the lease term for purposes of establishing an amortization period.