Advance Auto Parts 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-19

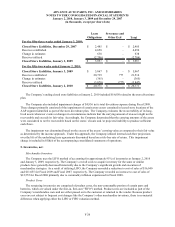

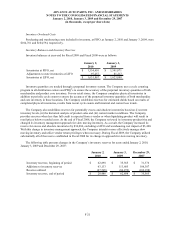

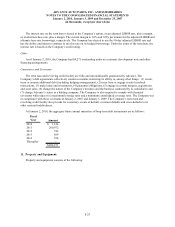

Prior to Effect

of Accounting

Change Adjustments As Reported

Cost of sales, including purchasing

and warehousing costs 2,698,907$ 69,490$ 2,768,397$

Gross profit 2,713,716$ (69,490)$ 2,644,226$

Selling, general and administrative

ex

p

enses 2,259,331$ (69,490)$ 2,189,841$

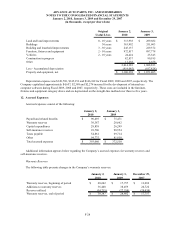

As Previously

Reported Adjustments As Adjusted

Cost of sales, includin

g

p

urchasin

g

and warehousing costs 2,679,191$ 63,940$ 2,743,131$

Gross profit 2,463,064$ (63,940)$ 2,399,124$

Selling, general and administrative

ex

p

enses 2,048,137$ (63,940)$ 1,984,197$

As Previously

Reported Adjustments As Adjusted

Cost of sales, including purchasing

and warehousing costs 2,523,435$ 62,230$ 2,585,665$

Gross

p

rofit 2,320,969$ (62,230)$ 2,258,739$

Selling, general and administrative

ex

p

enses 1,904,540$ (62,230)$ 1,842,310$

Fifty-Two week period ended December 29, 2007

Fifty-Two week period ended January 2, 2010

Fifty-Three week period ended January 3, 2009

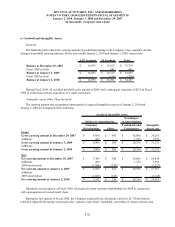

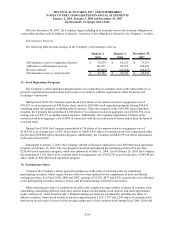

4. Store Closures and Impairment:

During Fiscal 2009, the Company closed 55 stores and relocated 10 stores, 45 of which were designated under

the store divestiture plan. The remaining store closures were part of the Company’s routine review and closure of

underperforming stores at or near the end of their respective lease terms. The store divestiture plan consisted of a

review of operating stores to identify locations for potential closing based on both financial and operating factors.

These factors included cash flow, profitability, strategic market importance, store full potential and current lease

rates.

During Fiscal 2009, the Company recognized $27,725 of total expense associated with its closed store activities,

$26,057 of which was divestiture related, or divestiture expense. For Fiscal 2009, divestiture expense included

closed store exit costs of $21,121. The closed store exit costs primarily included the establishment of the liability for

future lease obligations as well as severance. Closed store liabilities include the present value of the remaining lease

obligations and management’s estimate of future costs of insurance, property tax and common area maintenance

(reduced by the present value of estimated revenues from subleases and lease buyouts). New provisions are

established by a charge to SG&A in the accompanying consolidated statements of operations at the time the

facilities actually close.

A summary of the Company’s closed store liabilities, which are recorded in Accrued expenses (current portion)

and Other long-term liabilities (long-term portion) in the accompanying consolidated balance sheet, are presented in

the following table: