Advance Auto Parts 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-20

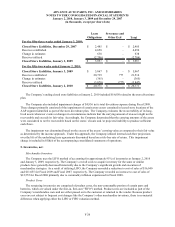

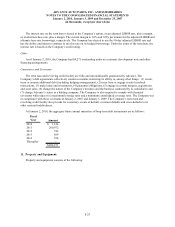

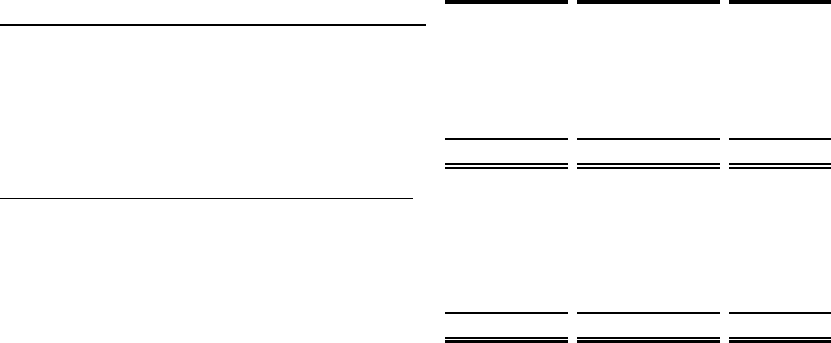

Lease

Obligations

Severance and

Other Exit Total

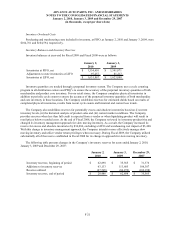

For the fifty-three weeks ended January 3, 2009:

Closed Store Liabilities, December 29, 2007 2,485$ -$ 2,485$

Reserves established 4,650 - 4,650

Change in estimates 638 - 638

Reserves utilized (2,706) - (2,706)

Closed Store Liabilities, January 3, 2009 5,067$ -$ 5,067$

For the fifty-two weeks ended January 2, 2010:

Closed Store Liabilities, January 3, 2009 5,067$ -$ 5,067$

Reserves established 20,739 777 21,516

Change in estimates (365) - (365)

Reserves utilized (5,070) (777) (5,847)

Closed Store Liabilities, January 2, 2010 20,371$ -$ 20,371$

The Company’s ending closed store liabilities at January 2, 2010 included $18,050 related to the store divestiture

plan.

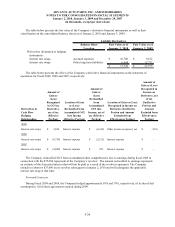

The Company also included impairment charges of $4,936 in its total divestiture expense during Fiscal 2009.

These charges primarily consisted of the impairment of certain store assets contained in leased store locations of the

AAP segment identified as part of the store divestiture plan. The Company evaluates the recoverability of its long-

lived assets whenever events or changes in circumstances indicate that the carrying amount of an asset might not be

recoverable and exceeds its fair value. Accordingly, the Company determined that the carrying amounts of the assets

were considered to not be recoverable based on the stores’ closure and /or projected inability to produce sufficient

cash flows.

The impairment was determined based on the excess of the assets’ carrying value as compared to their fair value

as determined by the income approach. Under this approach, the Company utilized internal cash flow projections

over the life of the underlying lease agreements discounted based on a risk-free rate of return. This impairment

charge is included in SG&A of the accompanying consolidated statements of operations.

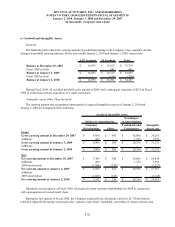

5. Inventories, net:

Merchandise Inventory

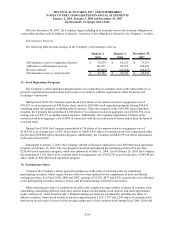

The Company uses the LIFO method of accounting for approximately 95% of inventories at January 2, 2010

and January 3, 2009, respectively. The Company’s overall costs to acquire inventory for the same or similar

products have generally decreased historically due to the Company’s significant growth and execution of

merchandise strategies. As a result of utilizing LIFO, the Company recorded a reduction to cost of sales of $16,040

and $11,055 for Fiscal 2009 and Fiscal 2007, respectively. The Company recorded an increase to cost of sales of

$12,555 for Fiscal 2008 primarily due to commodity inflation experienced in Fiscal 2008.

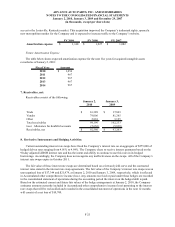

Product Cores

The remaining inventories are comprised of product cores, the non-consumable portion of certain parts and

batteries, which are valued under the first-in, first-out ("FIFO") method. Product cores are included as part of the

Company’s merchandise costs and are either passed on to the customer or returned to the vendor. Because product

cores are not subject to frequent cost changes like the Company’s other merchandise inventory, there is no material

difference when applying either the LIFO or FIFO valuation method.