Advance Auto Parts 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

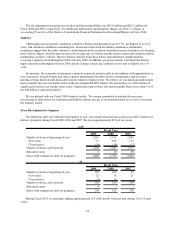

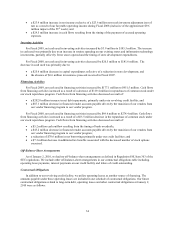

At January 2, 2010, our cash and cash equivalents balance was $100.0 million, an increase of $62.7 million

compared to January 3, 2009 (the end of Fiscal 2008). This increase resulted from additional cash flows from

operating activities (including higher net income, slower growth in inventory, net of our accounts payable ratio, and

increase in deferred income taxes) and a decrease in repurchases of our common stock partially offset by an increase

in the net repayment of debt. Additional discussion of our cash flow results is set forth in the Analysis of Cash Flows

section.

At January 2, 2010, our outstanding indebtedness was $251.9 million lower when compared to January 3, 2009

and consisted of borrowings of $200.0 million under our term loan, $3.3 million outstanding on an economic

development note and $1.0 million outstanding under other financing arrangements. Additionally, we had $99.8

million in letters of credit outstanding, which reduced our total availability under the revolving credit facility to

$650.2 million. The letters of credit serve as collateral for our self-insurance policies and routine purchases of

imported merchandise.

We have 15 lenders participating in our revolving credit facility, each with a commitment of not more than 15%

of the total $750 million commitment. All of these lenders have met their contractual funding commitments to us

through January 2, 2010. An inability to obtain sufficient financing at cost-effective rates could have a materially

adverse impact on our business, financial condition, results of operations and cash flows.

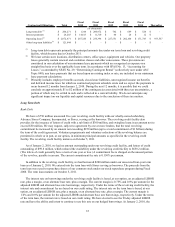

Capital Expenditures

Our primary capital requirements have been the funding of our continued store expansion program, including

new store openings and store acquisitions, store relocations, maintenance of existing stores, the construction and

upgrading of distribution centers, and the development of proprietary information systems and purchased

information systems. Our capital expenditures were $192.9 million in Fiscal 2009, or $7.9 million more than Fiscal

2008, primarily due to routine spending on our existing stores and information technology investments, partially

offset by fewer stores opened and the timing of store development expenditures. During Fiscal 2009, we opened 75

AAP and 32 AI stores, remodeled 13 AAP stores and relocated 6 AAP and 4 AI stores.

Our future capital requirements will depend in large part on the number of and timing for new stores we open or

acquire within a given year and the investments we make in information technology and supply chain networks.

During Fiscal 2010, we anticipate adding 110 new AAP and 40 new AI stores. We expect to relocate and remodel

existing stores only in the normal course of business.

We also plan to make continued investments in the maintenance of our existing stores and supply chain network

and to invest in new information systems to support our turnaround strategies, including the multi-year

implementation of a merchandising system. In Fiscal 2010, we anticipate that our capital expenditures will be

approximately $220.0 million to $240.0 million.

Stock Repurchase Program

Our stock repurchase program allows us to repurchase our common stock on the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the Securities and Exchange

Commission.

During Fiscal 2009, we repurchased 2.5 million shares of common stock at an aggregate cost of $99.6 million,

or an average price of $40.36 per share, leaving $89.4 million remaining under our $250 million stock repurchase

program, excluding related expenses.

Subsequent to January 2, 2010, our Board of Directors authorized a new $500 million stock repurchase program

on February 16, 2010. The new program cancelled and replaced the remaining portion of our previous $250 million

stock repurchase program, which was authorized on May 15, 2008. As of February 26, 2010, we have repurchased

1.4 million shares of our common stock at an aggregate cost of $56.2 million, or an average price of $40.40 per

share, under our $500 million stock repurchase program.