Advance Auto Parts 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

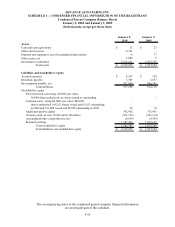

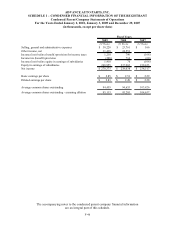

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-36

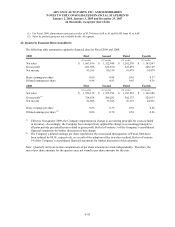

and interest cost would have been a decrease of $10 for Fiscal 2009.

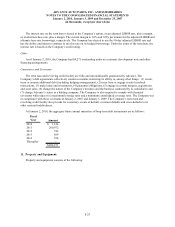

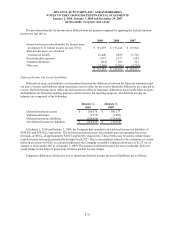

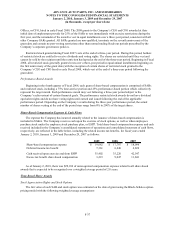

The postretirement benefit obligation and net periodic postretirement benefit cost was computed using the

following weighted average discount rates as determined by the Company’s actuaries for each applicable year:

2009 2008

Postretirement benefit obligation 6.25% 6.00%

Net periodic postretirement benefit cost 5.00% 6.25%

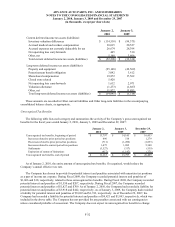

The Company expects plan contributions to completely offset benefits paid. The following table summarizes the

Company's expected benefit payments (net of retiree contributions) to be paid for each of the following fiscal years:

Amount

2010 789$

2011 811

2012 816

2013 806

2014 819

2015-2019 2,931

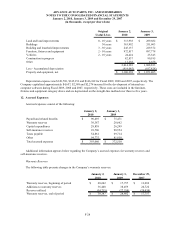

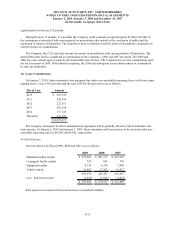

At January 2, 2010, the net unrealized gain on the Plan consists of an unrealized gain of $4,112 related to prior

service cost and an unrealized net gain of $1,799 related to actuarial gains. Approximately $581 of the unrealized

gain related to prior service cost and $103 related to the actuarial gain are expected to be recognized as a component

of Net periodic postretirement benefit cost in Fiscal 2010.

The Company reserves the right to change or terminate the employee benefits or Plan contributions at any time.

Any changes in the Plan or revisions to assumptions that affect the amount of expected future benefits may have a

material impact on the amount of the reported obligation, annual expense and projected benefit payments.

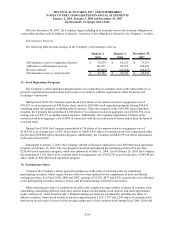

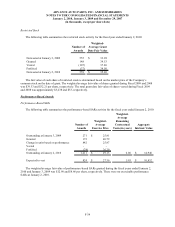

19. Share-Based Compensation:

Overview

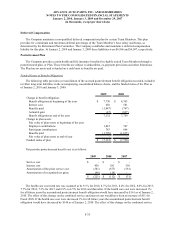

The Company grants share-based compensation awards to its employees and members of its Board of Directors

as provided for under the Company’s 2004 Long-Term Incentive Plan, or LTIP. Prior to Fiscal 2007, the Company

granted equity compensation to its employees in the form of fixed stock options and deferred stock units, or DSUs,

that vested over time. Beginning in Fiscal 2007, the Company phased out the granting of stock options by primarily

granting stock appreciation rights, or SARs, and restricted stock (considered nonvested stock under ASC Topic

718), which also vest over time.

During the fourth quarter of Fiscal 2008, the Company shifted its annual LTIP grant cycle from the first quarter

to the fourth quarter of the fiscal year, which will enable performance targets and awards to be put in place prior to

the commencement of the performance period. Therefore, the Company made two annual share-based grants during

Fiscal 2008.

General Terms of Awards

Time Vested Awards

The terms of the SARs granted are similar in several respects to the stock options previously granted. The SARs

generally vest over a three-year period in equal annual installments beginning on the first anniversary of the grant

date, with the exception of SARs granted to the Company’s Chief Executive Officer, or CEO, and Chief Financial