Advance Auto Parts 2009 Annual Report Download - page 67

Download and view the complete annual report

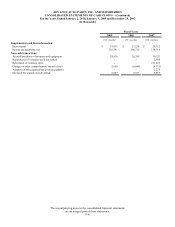

Please find page 67 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-14

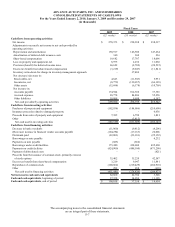

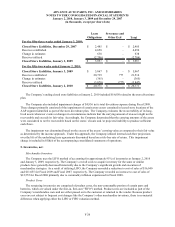

Financed Vendor Accounts Payable

The Company is party to a short-term financing program with a bank allowing it to extend its payment terms on

certain merchandise purchases. The substance of the program is for the Company to borrow money from the bank to

finance purchases from vendors. The Company records any discount given by the vendor to its inventory and

accretes this discount to the resulting short-term payable to the bank through interest expense over the extended

term. At January 2, 2010 and January 3, 2009, $32,092 and $136,386, respectively, was payable to the bank by the

Company under this program and is included in the accompanying consolidated balance sheets as Financed vendor

accounts payable.

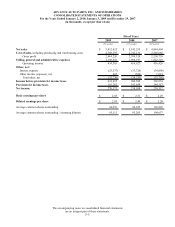

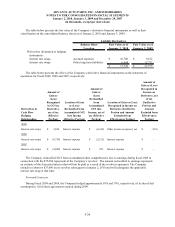

Earnings per Share

The Company adopted FASB Staff Position, or FSP, EITF 03-6-1, “Determining Whether Instruments Granted

in Share-Based Payment Transactions Are Participating Securities,” effective January 4, 2009 (now included in

overall earnings per share guidance under ASC Topic 260). FSP EITF 03-6-1 addresses whether instruments granted

in share-based payment awards are participating securities prior to vesting, and therefore, need to be included in the

earnings allocation when computing earnings per share under the two-class method. Unvested share-based payment

awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

participating securities and shall be included in the computation of earnings per share pursuant to the two-class

method. Certain of the Company’s shares granted to employees in the form of restricted stock are considered

participating securities which require the use of the two-class method for the computation of basic and diluted

earnings per share.

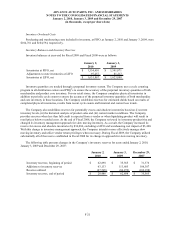

Accordingly, earnings per share is determined using the two-class method and is computed by dividing net

income attributable to the Company’s common shareholders by the weighted-average common shares outstanding

during the period. The two-class method is an earnings allocation formula that determines income per share for each

class of common stock and participating security according to dividends declared and participation rights in

undistributed earnings. Diluted income per common share reflects the more dilutive earnings per share amount

calculated using the treasury stock method or the two-class method.

Basic earnings per share of common stock has been computed based on the weighted-average number of

common shares outstanding during the period, which is reduced by stock held in treasury and shares of nonvested

restricted stock. Diluted earnings per share of common stock reflects the weighted-average number of shares of

common stock outstanding, outstanding deferred stock units and the impact of outstanding stock options, and stock

appreciation rights (collectively “share-based awards”). Diluted earnings per share are calculated by including the

effect of dilutive securities.

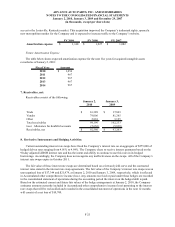

Lease Accounting

The Company leases certain store locations, distribution centers, office space, equipment and vehicles. Initial

terms for facility leases are typically 10 to 15 years, with renewal options at five year intervals, and may include rent

escalation clauses. The total amount of the minimum rent is expensed on a straight-line basis over the initial term of

the lease unless external economic factors exist such that renewals are reasonably assured, in which case the

Company would include the renewal period in its amortization period. In those instances, the renewal period would

be included in the lease term for purposes of establishing an amortization period and determining if such lease

qualified as a capital or operating lease. In addition to minimum fixed rental payments, some leases provide for

contingent facility rentals. Contingent facility rentals are determined on the basis of a percentage of sales in excess

of stipulated minimums for certain store facilities as defined in the individual lease agreements. Most of the leases

provide that the Company pay taxes, maintenance, insurance and certain other expenses applicable to the leased

premises. Management expects that in the normal course of business leases that expire will be renewed or replaced

by other leases.