Advance Auto Parts 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-37

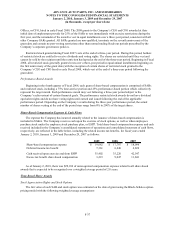

Officer, or CFO, hired in early Fiscal 2008. The 2008 grants to the Company’s CEO and CFO awarded at their

initial date of employment provide for 25% of the SARs to vest immediately with exercise restrictions during the

first year, and the remainder of the award to vest in equal installments over a three-year period, consistent with all

other Company SARs granted. All SARs granted are non-qualified, terminate on the seventh anniversary of the

grant date and contain no post-vesting restrictions other than normal trading black-out periods prescribed by the

Company’s corporate governance policies.

Restricted stock granted during Fiscal 2007 vests at the end of a three-year period. During this period, holders

of restricted stock are entitled to receive dividends and voting rights. The shares are restricted until they vest and

cannot be sold by the recipient until the restriction has lapsed at the end of the three-year period. Beginning in Fiscal

2008, all restricted stock generally granted vests over a three-year period in equal annual installments beginning on

the first anniversary of the grant date (with the exception of certain shares of restricted stock granted to the

Company’s CEO and CFO hired in early Fiscal 2008, which vest at the end of a three-year period following the

grant date).

Performance-Based Awards

Beginning in the fourth quarter of Fiscal 2008, each grant of share-based compensation is comprised of SARs

and restricted stock, including a 75% time-service portion and 25% performance-based portion which collectively

represent the target award. Each performance award may vest following a three-year period subject to the

Company’s achievement of certain financial goals. The performance restricted stock awards do not have dividend

equivalent rights and do not have voting rights until earned and issued following the end of the applicable

performance period. Depending on the Company’s results during the three-year performance period, the actual

number of shares vesting at the end of the period may range from 0% to 200% of the target shares.

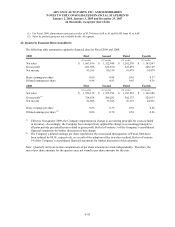

Share-Based Compensation Expense & Cash Flows

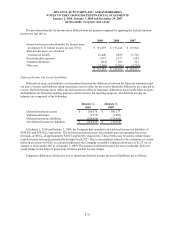

The expense the Company has incurred annually related to the issuance of share-based compensation is

included in SG&A. The Company receives cash upon the exercise of stock options, as well as when employees

purchase stock under the employee stock purchase plan, or ESPP. Total share-based compensation expense and cash

received included in the Company’s consolidated statements of operations and consolidated statement of cash flows,

respectively, are reflected in the table below, including the related income tax benefits, for fiscal years ended

January 2, 2010, January 3, 2009 and December 29, 2007 as follows:

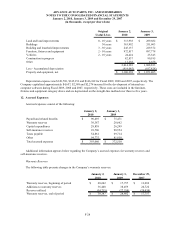

2009 2008 2007

Share-based compensation expense 19,682$ 17,707$ 18,096$

Deferred income tax benefit 7,361 6,640 6,822

Cash received upon exercise and from ESPP 35,402 35,220 42,547

Excess tax benefit share-based compensation 3,219 9,047 11,841

As of January 2, 2010, there was $29,180 of unrecognized compensation expense related to all share-based

awards that is expected to be recognized over a weighted average period of 2.0 years.

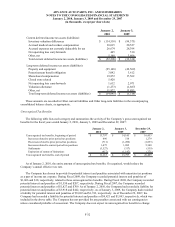

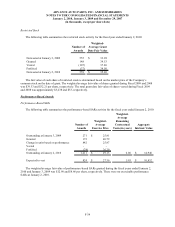

Time-Based Share Awards

Stock Appreciation Rights and Stock Options

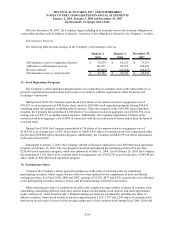

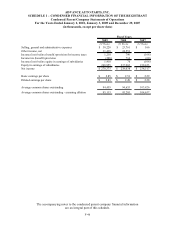

The fair value of each SAR and stock option was estimated on the date of grant using the Black-Scholes option-

pricing model with the following weighted average assumptions: