Advance Auto Parts 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

entire portion of our bank debt was hedged through the use of interest rate swaps which effectively fixed our LIBOR

at rates ranging from 4.01% to 4.98%.

Other

As of January 2, 2010, we had $4.3 million outstanding under an economic development note and other

financing arrangements.

Guarantees and Covenants

The term loan and revolving credit facility are fully and unconditionally guaranteed by Advance Auto Parts,

Inc. Our debt agreements collectively contain covenants restricting our ability to, among other things: (1) create,

incur or assume additional debt (including hedging arrangements), (2) incur liens or engage in sale-leaseback

transactions, (3) make loans and investments, (4) guarantee obligations, (5) engage in certain mergers, acquisitions

and asset sales, (6) change the nature of our business and the business conducted by our subsidiaries and (7) change

our status as a holding company. We are also required to comply with financial covenants with respect to a

maximum leverage ratio and a minimum consolidated coverage ratio. We were in compliance with these covenants

at January 2, 2010 and January 3, 2009. Our term loan and revolving credit facility also provide for customary

events of default, covenant defaults and cross-defaults to our other material indebtedness.

Credit Ratings

At January 2, 2010, we had credit ratings from Standard & Poor’s of BB+ and from Moody’s Investor Service

of Ba1, both of which are unchanged from January 3, 2009. The current outlooks by Standard & Poor’s and

Moody’s are stable and positive, respectively. The current pricing grid used to determine our borrowing rates under

our term loan and revolving credit facility is based on our credit ratings, irrespective of the rating agencies’

outlooks. If these credit ratings decline, our interest expense may increase. Conversely, if these credit ratings

improve, our interest expense may decrease. In addition, if our credit ratings decline, our access to financing may

become more limited.

Recent Accounting Developments

We adopted several new accounting pronouncements as of the beginning of Fiscal 2009.

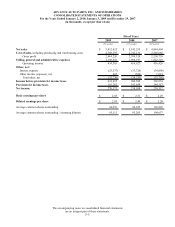

Earnings per Share

Earnings per share is determined using the two-class method and is computed by dividing net income

attributable to our common shareholders by the weighted-average common shares outstanding during the period.

The two-class method is an earnings allocation formula that determines income per share for each class of common

stock and participating securities according to dividends declared and participation rights in undistributed earnings.

Diluted income per common share reflects the more dilutive earnings per share amount calculated using the treasury

stock method or the two-class method. Upon adoption of the two-class method, prior-period earnings per share data

presented were adjusted retrospectively if applicable. As a result, our diluted earnings per share decreased by $0.01

for Fiscal 2008 and basic earnings per share decreased by $0.01 for Fiscal 2007. For a complete discussion of our

adoption of the two-class method, see Note 14 to the Consolidated Financial Statements in this Report on Form 10-

K.

Other

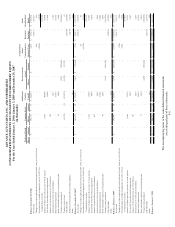

Effective as of the first quarter of Fiscal 2009, we added the expanded disclosures on fair value and hedging

activities as provided in Note 8, Derivative Instruments and Hedging Activities, and Note 9, Fair Value

Measurements, respectively, to the Consolidated Financial Statements in this Report on Form 10-K.